Meanwhile, most of the sectors are nearly “frozen” by Covid-19 impacts, aquaculture and fisheries are still busy with new projects to be launched nationwide. Enterprise’s investment into aquaculture and fisheries is explained by the fact that such sectors are the potential to obtain great post-pandemic breakthroughs. The digital transformation trend for sustainable development in aquaculture and fisheries is also sharply invested by the enterprises.

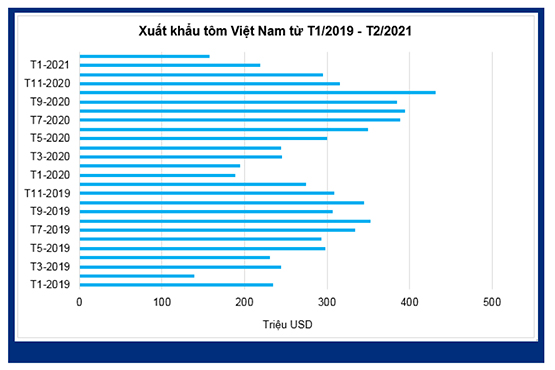

VASEP unveiled that the high demand for fisheries products, especially shrimp which is globally developed. With an average growth rate of nearly 7%/year, by 2045, total global shrimp output is expected to hit 15 million tons. Notably, despite the Covid-19 epidemic impact, the 2020 export turnover of US$ 3.7 billion was still obtained by the shrimp sector, an increase of 11% compared to 2019. Such an increasing trend was still clear when the first five months of 2021 were recorded with shrimp export of US$ 1.34 billion, an increase of 14% compared to the same period.

Mr. Tran Van Linh – Chairman of Board of Directors Thuan Phuoc Seafoods and Trading Corporation – analyzed: 2021 witnessed the remarkable increase ininvestor’s trust in shrimp sector upon Covid-19 pandemics thanks to the Government’s drastic pandemic prevention and control policies and guidelines. Currently, shrimp demand in the US retail segment is still good and new POs are continued to be fulfilled.

“Right from the beginning of 2021, Thuan Phuoc Seafoods and Trading Corporation inaugurated An An Shrimp Processing Plant in Tien Giang. The plant was characterized by a processing capacity of approximately 50 tons of finished shrimp/day and a 3,000-ton cold chain system, invested with over VND 400 billion. 200-ha shrimp farming area was also developed at Ba Tri, Ben Tre. With such activeness, we expect that this year’s export would hit US$ 130 million, up to 30% against 2020”

Mr. Tran Van Linh

Chairman of Board of Directors Thuan Phuoc Seafoods and Trading Corporation

Like Thuan Phuoc, Minh Phu Seafood Corporation expected that Minh Phat Seafood Processing Plant shall be constructed in Q2/2021, located at Khanh An Industrial Park (Ca Mau), injected with investment capital of VND 1,000 billion. Minh Phu is also known with 10-member companies, including 4 shrimp processing plants and 8 Group companies. Each member is a critical chain in the entire shrimp production value string of Minh Phu.

Moreover, in the shrimp sector’s value chain, Viet-Uc Seafood Corporation – a giant, specialized in supplying shrimp breed, unveiled that it is planned to construct a high-quality shrimp farming/production complex in Quang Ninh. Although specific time was not revealed, this enterprise affirmed that complex construction aims to go ahead with today’s shrimp sector’s active growth trend.

In addition to shrimp, Vietnam’s swine and poultry farming sector were highly appreciated as the study released by Oxford Economics unveiled that, last year, Vietnam’s agriculture – foodstuff segment witnessed a 4% growth rate meanwhile this segment in Thailand and the Philippines was narrowed down. Indonesia was also recorded with a positive growth rate, but equal to half of Vietnam. This was understandable as Vietnam’s breeding sector attracted big investment capital from domestic and foreign players.

While, for the foreign enterprise – C.P. Vietnam Livestock Co., Ltd was ranked on the top with highest investment capital into agriculture. Mr. Montri Suwanposri – CEO of C.P. Vietnam Livestock Co., Ltd (CPV) unveiled that: Currently, CPV has 12 feed plants with a total capacity of 4.2 million tons/year. CPV has 2 seafood processing plants, 3 meat processing plants. At the end of 2020, Export Chicken Processing Plant Complex was inaugurated in Binh Phuoc. The Complex was invested with over US$ 250 million, having a maximum capacity of 100 million units/year, the biggest scale in Southeast Asia… In addition to the available plants, CPV’s investment was injected into swine slaughtering and cutting plants located at Phu Nghia, Hanoi to reduce intermediary phases, facilitating swine price reduction.

For domestic enterprise, currently, Masan MeatLife (under Masan Group) covered the meat processing business field with key companies of MNS Farm Nghe An, MNS Meat Ha Nam, and MeatDeli Saigon. Meanwhile, MNS Meat Ha Nam was known as the biggest meat processing complex, covering an area of over 10 hectares, a capacity of 1.4 million units/year, equivalent to 140,000 tons/year. In addition to the meat processing field, Masan MeatLife’s official operation was also recorded in feeds with outstanding units of Anco, Proconco, and Vissan. At the end of 2020, 13 feed plants with a total capacity of nearly 3.3 million tons/year were operated by Masan MeatLife.

Regarding poultry, at the beginning of this year, De Heus (Netherland) – the world’s leading feed supplier worked closely with partners such as Bel Chicken Group (Belgium) and Hung Nhon Group to launch construction investment into a 100% traceability chicken farming complex located in Tay Ninh Province. The above complex included a breed farm with a capacity of 1 million 1-day-age chick infants/week, 2 parent chicken farms with a total capacity of 25 million eggs/year. Moreover, this site was also characterized by 250 meat chicken farms with a total capacity of 25 million meat chicken/year and a food processing plant.

Thaifoods Group (Thailand) also invested US$ 23 million into chicken farms and a breed farm in Vietnam with a scale of 800,000 chicken/week in the next year. Thaifoods also planned to develop a slaughterhouse and a feed plant.

The recent studies unveiled that to satisfy the human food demand, the agricultural yield must increase by 60% by 2030. To respond the situation, the players were required to closely adhere to the digital transformation trends in agriculture. Only technology was the sustainable resource and scalable to facilitate the agriculture to thrive to a new height.

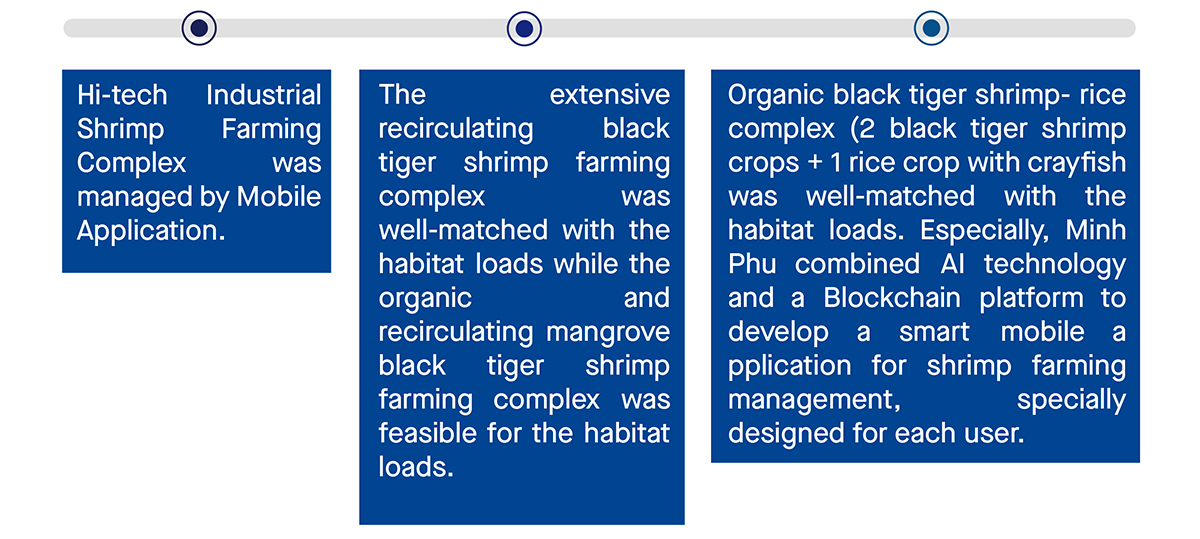

Minh Phu has launched R&D and successfully piloted the 2-N-4 high technology shrimp farming model for many years. Then, it was effectively put into operation in two 900-ha farming areas; cooperation with some Vietnamese and foreign research institutes has been also enhanced to modernize shrimp farming technology.

In the recent disclosure, Mr. Le Van Quang – Chief Executive Officer of Minh Phu Seafood Corporation unveiled that Minh Phu has planned to develop a green, clean, circulating organic and carbon neutral shrimp value chain. Concretely:

Mr. Nguyen Cong Can – Deputy General Director in charge of Techniques of Viet-Uc Seafood Corporation shared, to launch a close value string from parent shrimp, breed, feed, and commercial shrimp to processing, and each segment must be applied with outstanding technologies.

For CPV, Mr. Montri Suwanposri said that, after 27 years of investment into Vietnam, CPV has launched the close production and business model (farming, cultivating, production, and food processing) under modern circulating economic model-based traceability procedure. Particularly, C.P launched projects on minimizing plastic wastes, enhancing green tree coverage, making CPV plants to be much more green, clean and beautiful.

Mr. Montri Suwanposri

CEO of C.P. Vietnam Livestock Co., Ltd

“Green plant is an important criterion in each project developed by C.P. That is why plants and farms are also designed and developed towards environmentally friendly principles. ISO environment management standards, standards, and codes on synchronized and modern wastewater treatment, waste, and waste treatment plants are applied. Particularly, during plant & farm construction, lightweight, recycled and high-performance materials are prioritized by CPV”

Meanwhile, Masan MeatLife’s meat processing lines were provided by Marel – the world’s leading manufacturer of meat processing equipment in the Netherlands, supported by a 3-robot automation application in the system. The plant was operated under BRC standard – the world-leading standard on Food Safety, certified with HACCP, and directly operated, monitored, and tested by EU’s experienced experts. MEATDeli chilled meat was qualified with the National Standard (TCVN 12429:2018) on Chilled Meat recommended by the Ministry of Agriculture and Rural Development and released by the Ministry of Science and Technology.

Comment