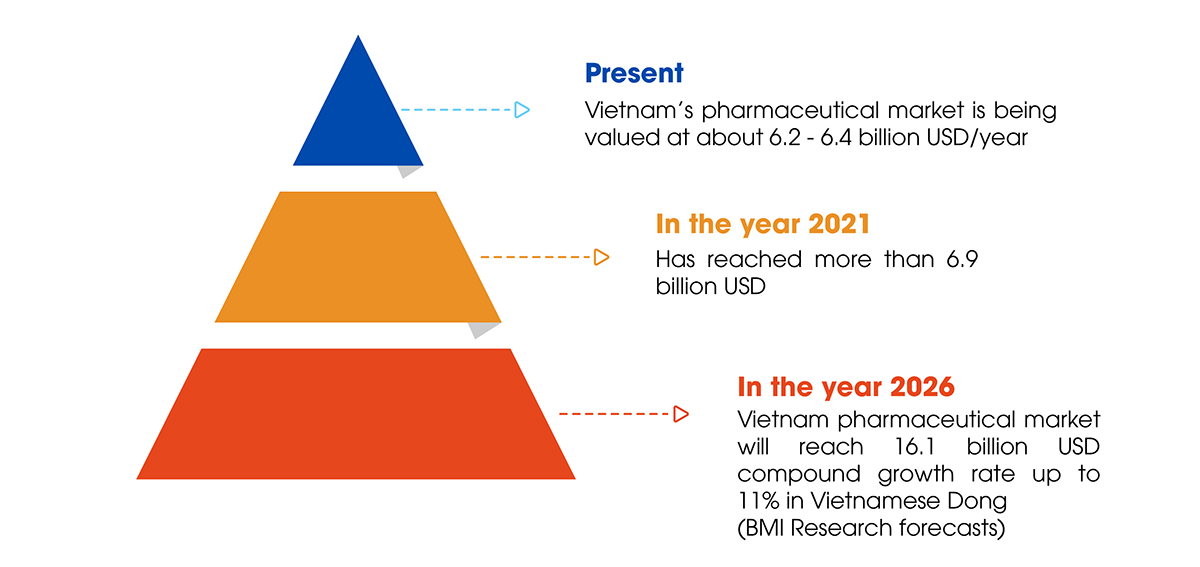

Despite significant progress, Vietnam’s pharmaceutical industry continues to struggle when it must stand on the shoulders of others. The domestic pharmaceutical market, worth more than $ 6 billion USD per year, serves as a “playground” for businesses from other countries.

The first factor mentioned by this expert is that Vietnam’s GDP growth rate is ranked third in Southeast Asia. In addition, the direction, mechanisms, and policies for the development of our country’s pharmaceutical industry are now very clear.

The Government approved the program to develop the domestic pharmaceutical and herbal medicine industry by 2030, with a vision to 2040, in March 2021, with the goal: to build the domestic pharmaceutical industry to develop at a high level, achieving level 4 according to World Health Organization (WHO) classification, have a market value in the top 3 in ASEAN, and contribute to ensuring the timely supply of quality, safe, effective, and reasonably priced medicines.

Most recently, Resolution 36 of the Politburo, issued on January 30, 2023, on the development and application of biotechnology for the sustainable development of the country in the new situation, establishes the requirement that by 2030, our country must be one of the top 10 Asian countries in biotechnology, meeting the research and development requirements of the industries.

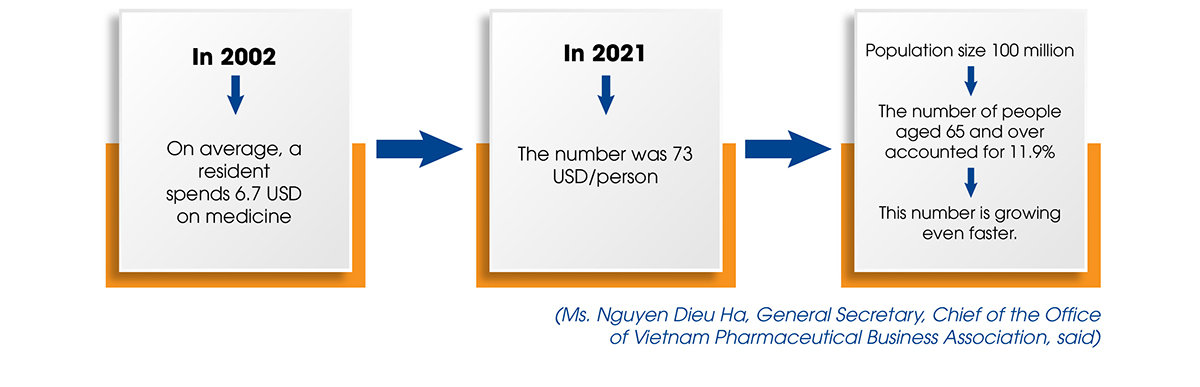

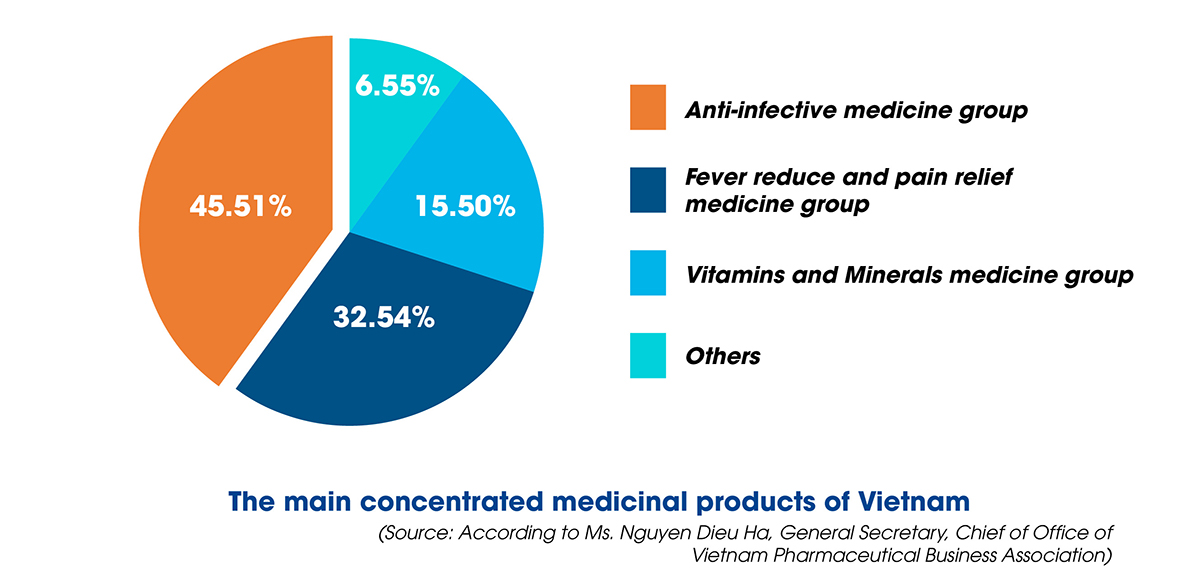

In terms of the market, Vietnamese people, like those in many other developing countries, are spending an increasing amount of money on medicines. This is an unavoidable development as people’s incomes rise over time and urbanization accelerates.

According to the General Secretary and Chief of the Office of the Vietnam Pharmaceutical Business Association, by 2022, Vietnam will have 51 foreign-invested pharmaceutical enterprises, 228 enterprises that meet WHO – GMP standards, and 12 enterprises that meet high GMP standards such as EU, PICs, JAPAN, and TCA.

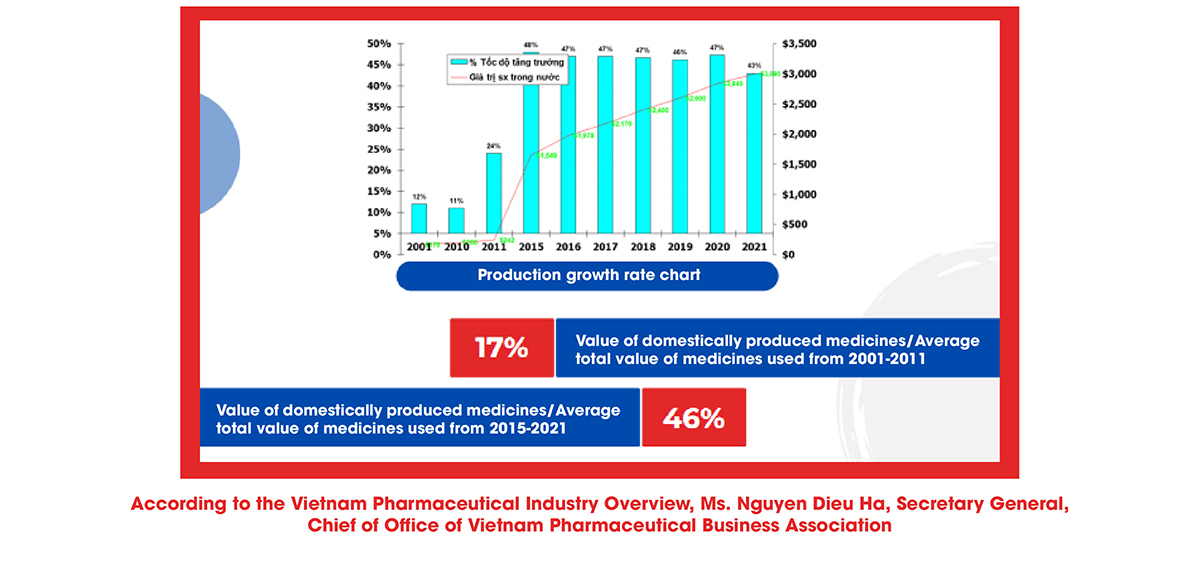

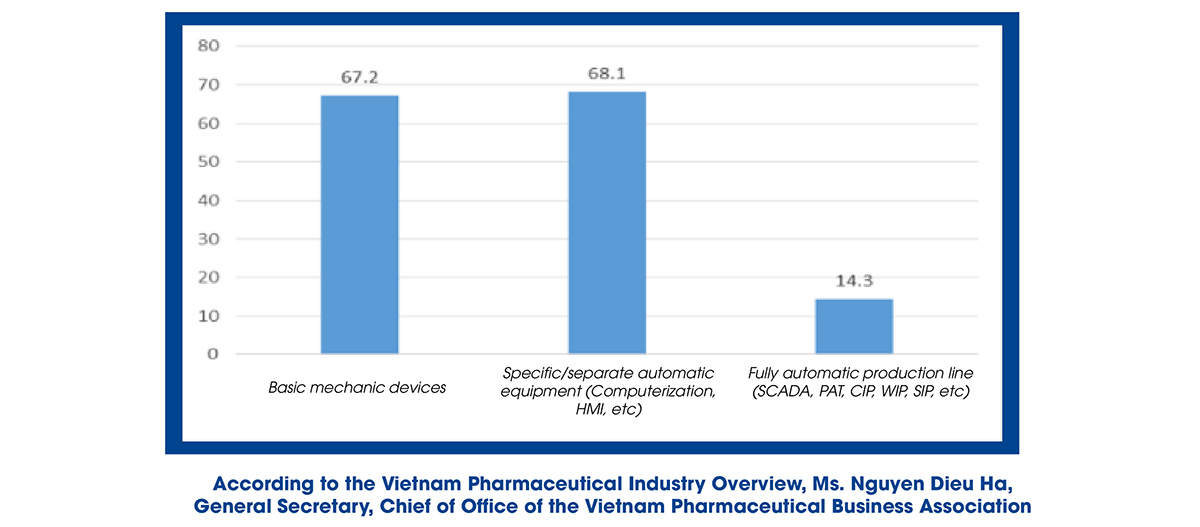

Ms. Nguyen Dieu Ha also said that the production line of herbal medicines still has many limitations, mainly producing generic drugs, not exploiting the total investment capacity, not researching and manufacturing expired medications, including the new technology transfer has yet to be entirely focused on. Regarding the degree of production automation, simple mechanical equipment (67.2%) and specific/distinctive automation equipment (68.1%) are mainly used, while the production line is completely automated and still has less amount.

According to Assoc. Prof. Dr. Le Van Truyen, the number of manufacturers meeting WHO – GMP standards remains low. Notably, no factory has been pre-approved by WHO, despite this being a critical factor in production, technology transfer, outsourcing, and export opportunities. Pharmaceutical enterprises’ production capacity is still limited and dispersed in the R&D stage (research and development). Vietnam still lacks a strong and modern national R&D center, as well as clinical trial research centers, solid biological research, and international qualifications.

Although the targets are quite ambitious, our country has not had a separate industrial park for the pharmaceutical industry with a complete ecosystem; there has not been a large corporation to lead; No national-scale pharmaceutical corporation has yet been established. Most pharmaceutical enterprises in Vietnam are small and medium-sized with limited financial capacity.

In addition, Mr. Dao Xuan Huong, Chairman of GMP Vietnam Joint Stock Company, shared that “most Vietnamese investors just want to receive high standard GMP certification so that their products can sell at high prices in the Vietnamese market but not sharing about their goals for consultants, while domestic consulting units or joint ventures with foreign countries only advise on technology, techniques, GMP but do not advise on the market, defining goals leads to interrupted cooperation without results, many businesses change consulting units several times.”

“The core issue is that each company needs to review/adjust/change its medium and long-term development strategy in line with the State’s guidelines, the international, regional and domestic business environment to improve the competitiveness of Vietnam’s pharmaceutical industry”, Assoc. Prof. Dr. Le Van Truyen, former Deputy Minister of Health, said.

Observing the world pharmaceutical industry developments, this expert made a series of specific recommendations to Vietnamese pharmaceutical businesses. For example, businesses worldwide have changed their market access strategies from “promoting” products for enterprises to supporting state agencies in disease control and proactively providing health services. In the process of digital transformation, the pharmaceutical industry has collected big data sources, effectively supporting decision-making. These are the points that the pharmaceutical industry and domestic pharmaceutical businesses can learn from.

As for the management agency, Assoc. Prof. Dr. Le Van Truyen said that the important task here is to create an open and favorable legal environment so businesses can go together and take advantage of each other’s advantages for mutual development. The management agency also needs a mechanism to encourage enterprises that have invested in GMP. Vietnam also needs a mechanism to support enterprises to apply for “first generic” or “super generic” applications to increase business motivation. According to Mr. Truyen, if an enterprise submits a “first generic” application in some countries, the management agency will not accept a foreign “first generic” application.

The business’ strengths are elite people; abundant financial resources (due to the high cost of R&D and the need for long-term investment); brand strength (concerned about product quality, constantly communicating that its products are the best in the world). However, the price of the product is the deciding factor in competition…

First, the company must formulate a strategy by setting and executing a goal to achieve the leading position in the market. But more than market dominance is needed.

Second, the company must develop a solid defensive strategy to protect the company’s comeback from the impact of competitors. A company can achieve outstanding and sustained performance only with an offensive and defensive strategy. Patents, trademarks, and industrial designs are examples of strategic assets providing a sustainable competitive advantage. They fulfill their defensive duties by protecting intangible assets.

Develop a growth strategy based on multiple models, such as forming partnerships with major manufacturers, establishing a position in joint product development before competitors emerge, and focusing on core growth – market penetration. Focus on R&D to obtain patents, protect trademarks, and thus build a brand reputation; improve customer service; partners have professional strength and financial capacity. Organic growth is a long-term opportunity, a “rocket” that provides a lower cost, faster, and less risky short-term ROI than external growth.

Comment