“If R&D investments are to be conducted in a professional manner, it will be a strategy to help a wide range of businesses make a breakthrough in branding, production processes, competitiveness consolidation, and growth promotion, particularly in the context of COVID-19 pandemic that has transformed business methods and economic structures”

Vietnam is one of the nations with a low rate of R&D investment for businesses. In comparison with other countries that we are competing with in the region or nations with which Vietnam has entered into several next generation Free Trade Agreements, Vietnam’s investment rate is, in fact, lower. The reason for the low investment in R&D is due to a long tradition of oviding processing services to foreign enterprises, resulting little to no initiative in research activities and requiring more investment in R&D.

However, in the last 10 years, some domestic enterprises have risen to participate in the global value chain by investing in R&D. It could be mentioned here some enterprises such as Thaco, VinGroup, etc. or in the leather and footwear sector, some enterprises have invested in the value chain. Although their products are still labelled with foreign brands, they are more proactive in their designs, screening the right technologies and materials for the products that their partners need such as TBS shoe company. In addition, in some newly emerging industries, there has also been a large investment in R&D including mechanical engineering, especially in the food processing industry. However, not many enterprises place a serious investment in R&D activities in Vietnam.

This is understandable when we are still among the group of countries with the processing economy, which

is deemed as the lowest value-added stage. However, in the coming market economy, we cannot maintain the

status of processing economy, but should gradually shift from processing to production by promoting R&D

activities.

In Vietnam, it seems that all mechanisms and policies to encourage R&D development are in place. For example, apart from the general law, a Small-to-Medium Enterprise (SME) support law is available out there. Otherwise, the Law on corporate income tax has incentives if investing in R&D, etc. However, all these policies are not synchronous, not centralized, leading to low efficiency.

Meanwhile for SMEs, their biggest lack is technology. Therefore, there must be a policy of linking between universities and research institutes with enterprises in the matter of technology transfer and human resource training. Specifically, the Government “buys” output products, not provides input funds for science-technology research facilities. In addition, there is also a constraint that except for basic research, applied research must have products and applications to receive the funding.

Along with that, SME support centers must be built in a more practical way. The support here is to help them connect the output to large enterprises in a way that organizations such as Jetro (Japan), Taitra (Taiwan), Kotra (Korea) and so on have been successfully implemented.

Currently, the Government has set an annual target to increase the annual labor productivity by 5-6%. Thus, it must be increased by the content of science and technology – but this content cannot be obtained by itself without investment in R&D. I emphasize that in the coming period, if we want to increase productivity, we must rely on technology, not on labor expansion. In the near future, the more competitive the market is, there will be no land for enterprises with low productivity and poor quality. That is not to mention when Vietnam joined FTAs such as Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CP-TPP), EU – Vietnam Free Trade Agreement (EVFTA); RCEP, etc. If we want to exploit the advantages of these FTAs, domestic enterprises, especially SMEs, must participate in the value chain, not be independent. Even enterprises that do not participate in export, only do domestic work have to change.

With the investment in R&D of enterprises, there will be 2 cases:

•First, their orientation wants to build independent products that will not be processed and it could be mentioned here some textile enterprises actively participating in the value chain.

•The second is they want to create new products, and new methods. The product here might not be new but the product creation process is new (also known as innovation). For example, Ikea brand is very famous in Sweden because they are very creative in building a successful product creation process.

Realizing the advantages from R&D investment, some Vietnamese enterprises have made large investments in R&D, for example the case of Thaco. This enterprise has invested in a production chain by itself in Chu Lai and owns a lot of components and accessories to increase the localization rate. But they still have difficulty, because from experience in other countries, there is not a single leading enterprise can do it all by itself but must outsource.

Thus, the Government should enact policies to support the “leading crane” enterprises. Because they will be the first to invest and link with SMEs to create a value chain. Along with that, it is necessary to synchronize each area, each location, each field, and each market and those must be programmed. In addition, we should promote a public-private partnership (PPP) model in development research because Vietnam currently has PPP in infrastructure.

Even the way of FDI attraction also must be changed. We are always proud of having more than 30 years of FDI attraction, but FDI enterprises and domestic enterprises have not had the linkage but developed sporadically. This is what makes us not successful in FDI attraction compared to some other countries. One of the reasons that has not been successful is that the technology transfer to develop domestic enterprises and FDI enterprises has not set a requirement. Here we can tell the story of Samsung Group when they put the majority of their enterprises into outsourcing but few domestic enterprises. There are 3 reasons:

-

The first is that domestic enterprises are not able to achieve the quality they want -

Second, some enterprises can achieve the quality but cannot produce the scale output they need

Second, some enterprises can achieve the quality but cannot produce the scale output they need

-

Third, they did not say it, but they found that it would not make them more profitable to place orders from local enterprises compared to facilitating Korean enterprises. From there, it can be drawn that when dragging such large corporations, we have not placed the request for technology support to develop enterprises, but only think about using local labor, budget contribution, etc.

According to the statistics of R&D in Vietnam, most domestic enterprises mainly choose to buy available and completed technology from non-corporate companies or research institutions. The form of association with research organizations to develop their own products or technologies for enterprises often receives less attention. However, a number of domestic and foreign enterprises start to promote research and development in Vietnam in order to increase their competitive advantage in the process of international integration.

In 2020, after 12 years of operating in Vietnam, with a total investment capital of over 17 billion USD, Samsung decided to build its own “headquarters” for its R&D center in Vietnam. This is also the first time, Samsung has deployed a private building abroad to serve R&D activities. The group currently has 37 R&D centers, but in addition to 6 centers in Korea, the remaining centers operate in leased offices. This proves that Samsung increasingly appreciates the role of the Vietnamese market for its investment and business activities.

In the past epidemic, enterprises that have invested in R&D have shown good resilience. Typical for the above is the steel manufacturing sector. Reports from the Vietnam Steel Association (VSA) show that the influence of Covid-19 has caused great difficulties for production and consumption of steel products, causing many domestic enterprises not to achieve the same growth rate as in previous years. However, NS BlueScope Vietnam is one of the few enterprises in this industry that achieved positive growth during the first 9 months of this year thanks to boosting investment in R&D. The investment in new technology development to lead the market is a strategic direction towards the sustainable development goals of this enterprise.

When other enterprises in the same industry catch up with zinc & aluminium alloy-coated steel technology, BlueScope affirmed its pioneering position by launching ActivateTM technology in 2019 integrated into the new generation COLORBOND® and ZINCALUME® steel.

It is known that to launch this technology, BlueScope’s R&D has spent 20 years of research and development with over 100 million Australian dollars of investment and more than 20 patents globally, more than 8,000 profile panels have undergone Q-Fog cycling testing and salt spray testing in laboratories, a further 10,000 panels have been tested in 22 different real-world and severe exposure sites in Australia and around the world.

Viettel established Viettel High Technology Industries Corporation (VHT), Viettel’s main research and production unit in the military and civil fields. VHT owns the whole process from researching, designing, fabricating, manufacturing and trading products with a vision of becoming a modern technology company with high knowledge content, brand name in the international market with a total revenue of 1.5 billion, in the top 3 of the largest patent companies in Vietnam with international standard laboratories and factories. Viettel is the first enterprise to have a patent protected in the United States.

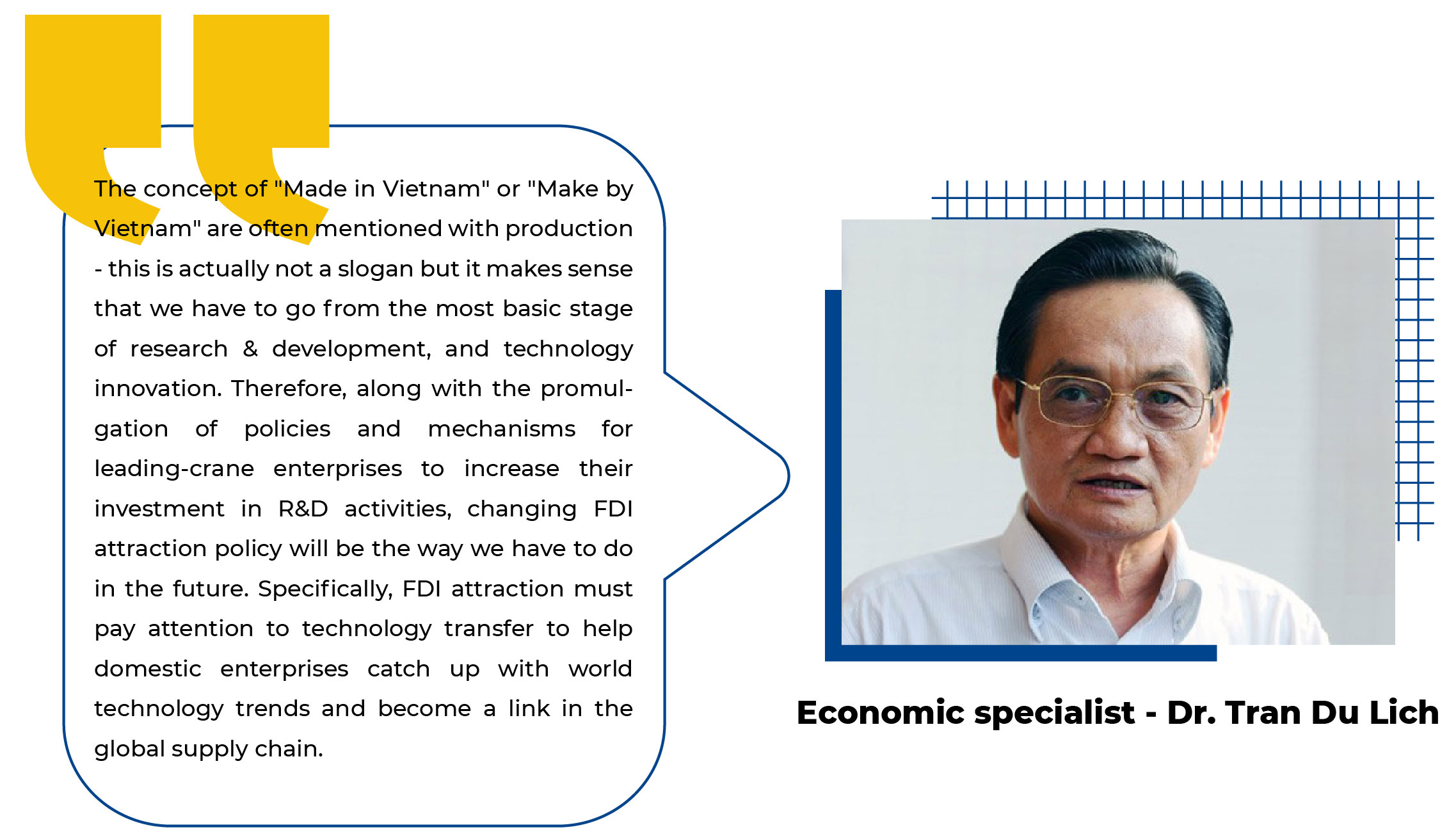

Comment