The supply of the industrial and logistics real estate market in the North is expected to double, while the new market is in the very first stage of development and will be a golden opportunity for investors. This subject content was exchanged during the recent Seminar on Industrial real estate and logistics market trends in Northern Vietnam which was recently co-organized by BlueScope and JLL in Hanoi.

In 2020, in the context of the gloomy world economy due to Covid-19, Vietnam is among the nations that see the highest GDP growth. According to JLL Vietnam, the country’s annual GDP growth will reach more than 6.5% over the next 15 years. It is estimated that by 2035 Vietnam’s economy will multiply 5 times (compared to 2020).

With a large number of attractive factors such as favorable geographical location, young population, favorable macroeconomic policy for investors, Vietnam has become a bright spot in attracting foreign investment, despite challenges exposed by the Covid-19 pandemic. According to JLL Vietnam, it is recorded in the first quarter of 2021 that FDI inflows into Vietnam increased by about 18.5% compared with the same period of 2020, with a focus on logistics and industrial real estate.

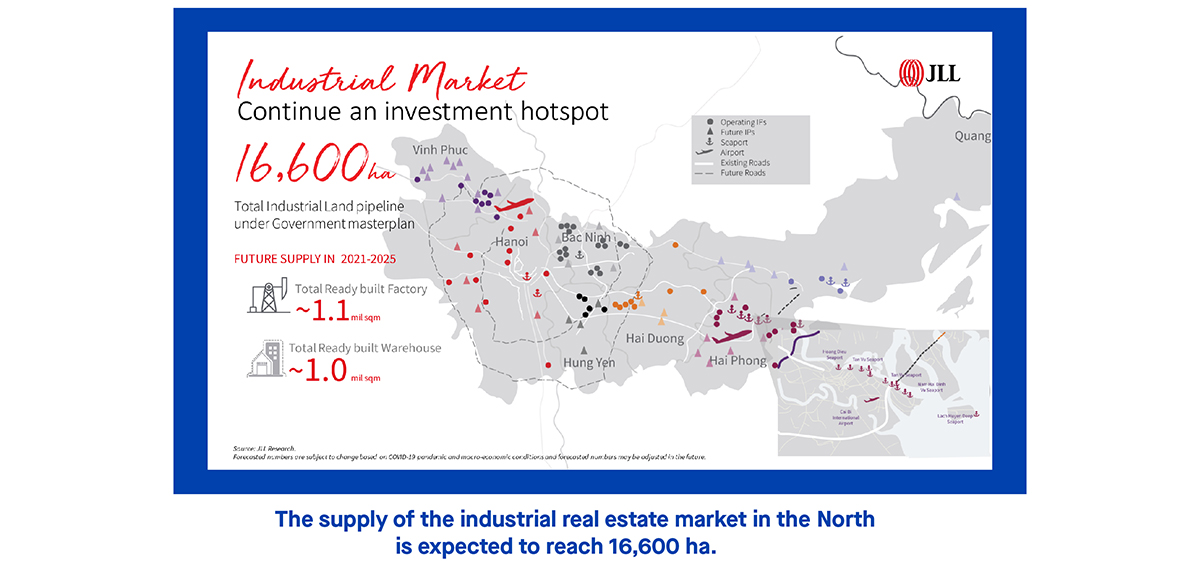

In particular, the total supply of industrial real estate in Northern Vietnam is 9,400 hectares and the occupancy rate is 76% with the rental price 10% higher than that in the South. This area also gathers high-value chains such as technologies, cars… The areas of Ha Noi, Hai Phong, and Bac Ninh concentrate the largest supply of the market.

In the future, the supply of real estate in the Northern industrial zone is expected to reach 16,600 hectares, nearly double the current supply. The North has a favorable location and well-connected infrastructure, close to not only Noi Bai airport and ports for water transport but also border gates to China. This area will be a major contributor to the development of Vietnam’s logistics market, said Ms. Trang Bui.

With 81% of investors planning to increase investment capital and to participate in Vietnam’s logistics market before the end of 2021, what will be an effective strategy to take advantage of the warehouse model in the future?

In fact, warehouses in Vietnam today are mainly the traditional “by paper” management, which is complicated and ineffective. “The world has built modern warehouses and well-arranged shelves with effective fire protection systems. Even large markets have automated warehouses, which use robots instead of the human labor force. Warehouses in Vietnam are just in their infancy and to develop from infancy to maturity is the potential of this segment,” said Ms. Trang Bui.

Therefore, what logistics companies need to do is to focus on improving the operational efficiency of their customers and optimizing the circulation of goods. “The land with a favorable location will not be available in the long term, so the trend is to develop high-rise warehouses to increase investment efficiency. Future warehouses, technology-integrated smart warehouses, and sustainable warehouses will be the trend in the industry in the coming period,” added Ms. Trang Bui.

This is also the trend that Mr. Vo Minh Nhut, Country President of NS BlueScope Vietnam recognized: “The first will be the trend of single logistics warehouses to transform into a center that integrates services from customs declaration to transportation and delivery management. The second trend is automation in using smart solutions to increase management efficiency. The third trend is sustainable development because suppliers pay more attention to environmental issues, reducing CO₂ emissions, toxic emissions … And the fourth trend is that warehouse quality must be higher to meet increasingly strict requirements of customers.”

Mr. Nhut pointed out that construction companies should be ahead of the two later trends in sustainable development and increasing quality. For example, a design consultant needs to advise on green buildings, applying the construction management system of BIM (Building Information Model) to provide 3D models for clients to experience the function and quality of the construction and resolve conflicts during design and construction at the lowest cost. Finally, the consultant should offer optimal solutions to help clients take advantage of the limited land fund.

At the same time, we also have a comprehensive solution from Lysaght. For example, we have the SMARTSEAM™ solution designed for a corrugated sheet and fringe system to slide on purlins, so as not to destroy the bonds when thermal expansion occurs.”

“In terms of materials, we have COLORBOND® adopting ACTIVATE™ four-phase matrix technology totally different from the conventional cold sheet. In addition to the corrosion resistance of ACTIVATE™ technology, COLORBOND® also is integrated with heat radiation to make the roof material up to 6 degrees cooler than the outdoor temperature; Clean technology to fight against the tropical pollution of Vietnam’s climate,” Mr. Vo Minh Nhut shared about NS BlueScope Vietnam’s solutions.

Comment