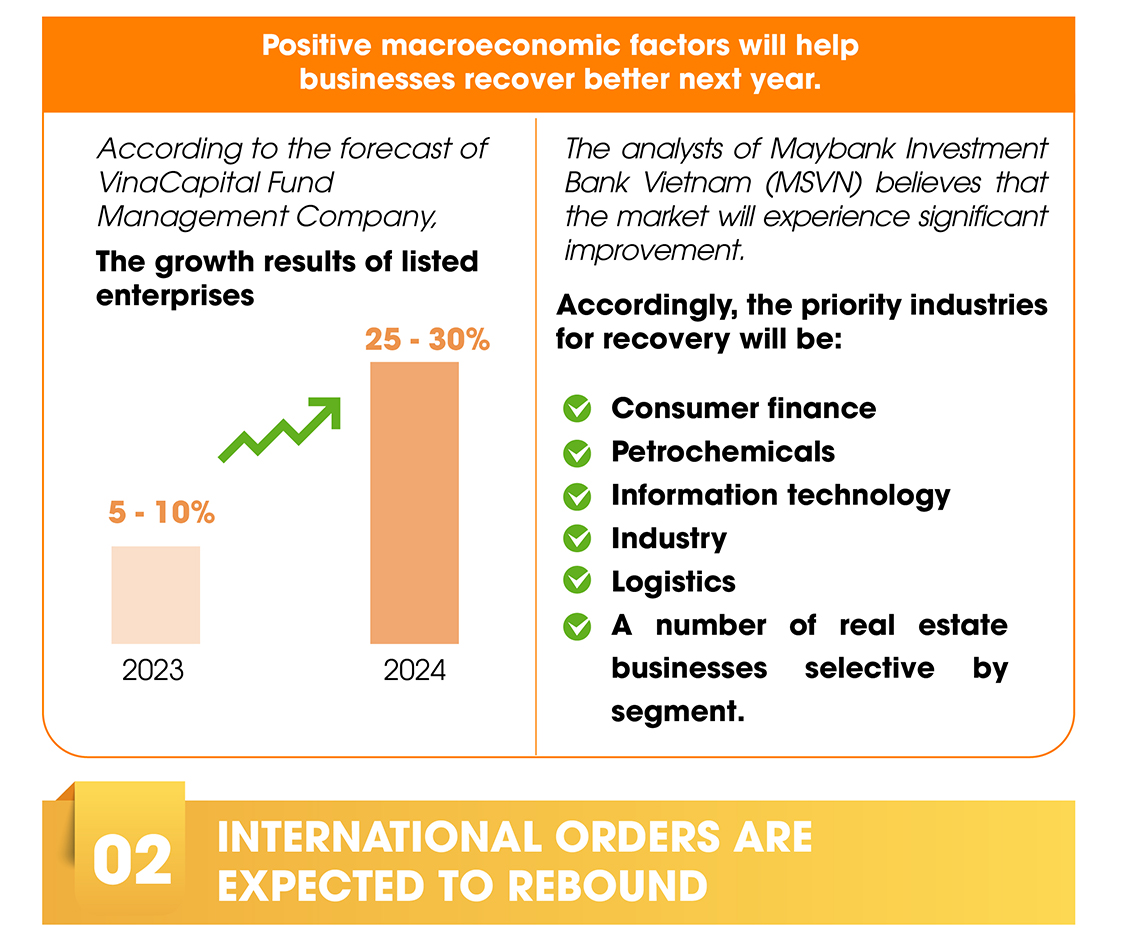

In light of macroeconomic stability, clear recovery indicators, and sustainable development trends in the first 9 months of 2023, the experts expect a stronger recovery in 2024, especially in some industries and fields.

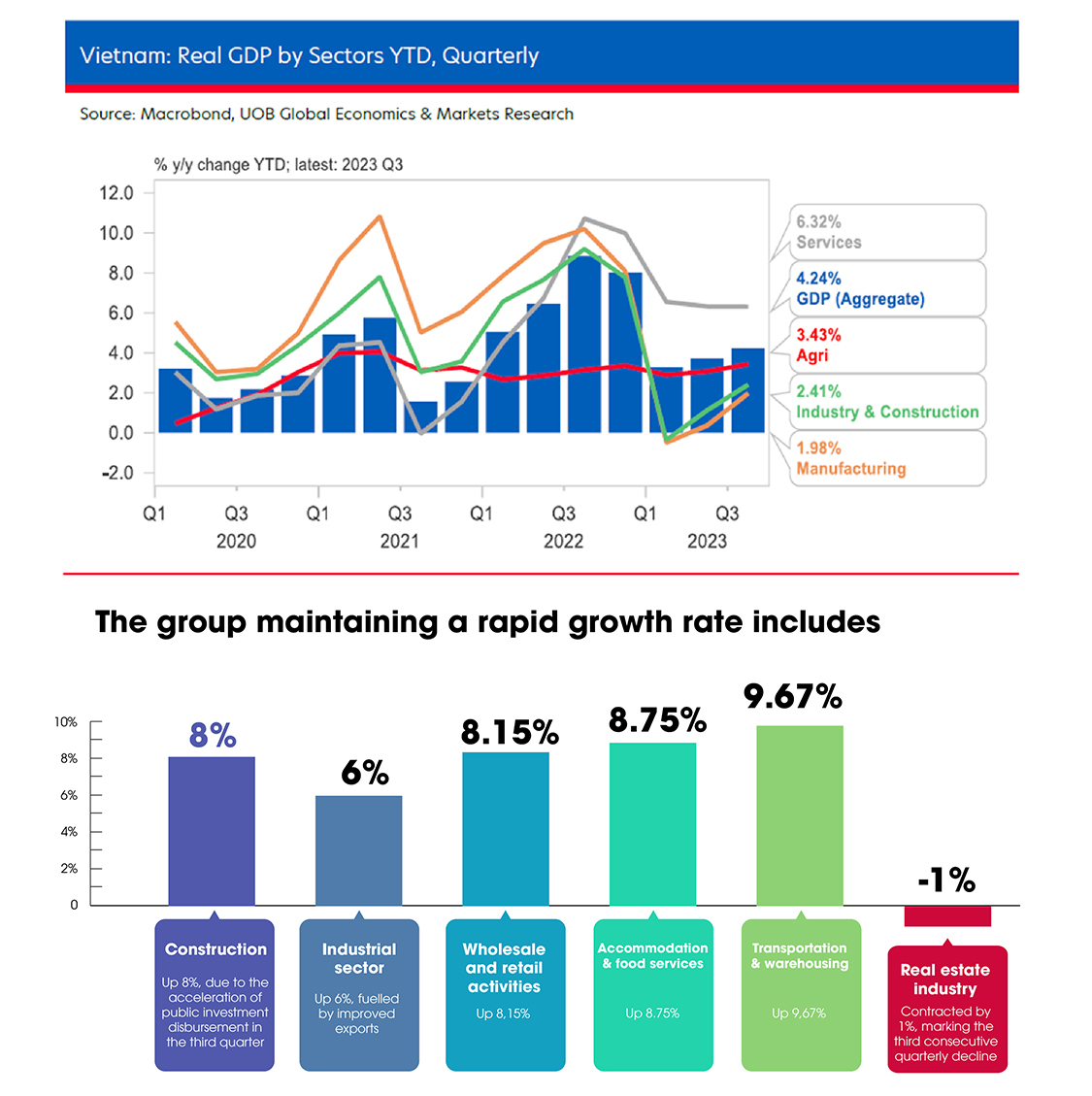

With a year-on-year increase of 4,24%, GDP growth in the first nine months of 2023 continues to recover and shows the light and dark shades, according to data by the General Statistics Office.

Experts predict the GDP growth for 2023 will hover around 5% instead of the previous projection of 6%. However, it is said that the market has bottomed out and entered the recovery phase.

A bright spot worth noting is that macroeconomic factors have been stabilizing as the banking system’s liquidity is abundant, exchange rates remain stable, and deposit interest rates have decreased. As a result, Vietnamese businesses can gradually reduce capital costs.

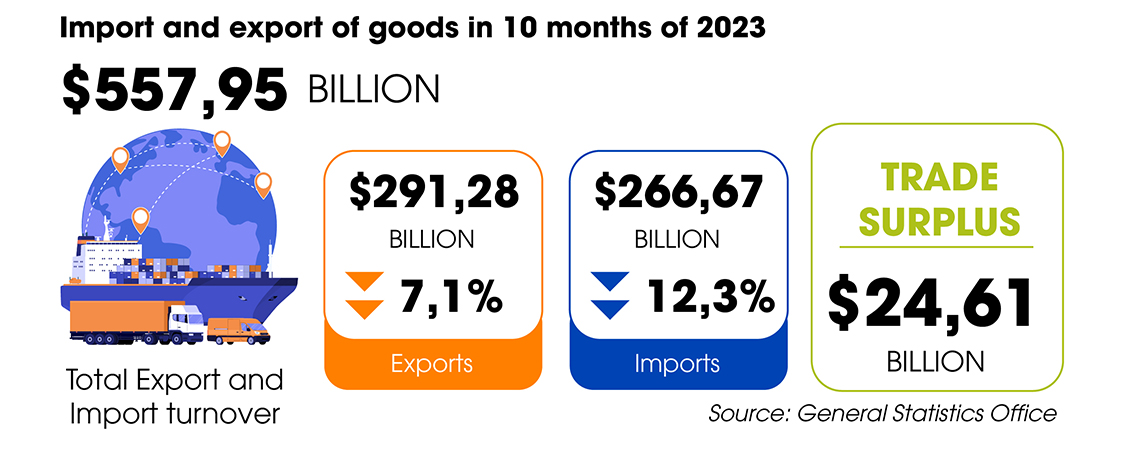

According to the latest data by the General Statistics Office, exports jumped 5.6% in October alone. Generally, in the first 10 months of 2023, some products with high export value include agricultural products (vegetables, rice, cassava, and cashew nuts), cement and clinker, iron and steel, paper, fiber, electronics, transport vehicles and spare parts.

Looking at inventory data in major markets, especially the US, most analysts believe that export orders are showing clearer signs of recovery. Last year, US retailers accumulated too many goods, but spending did not grow as expected, affecting this year’s exports.

Therefore, orders in some consumer industries, such as textiles and garments, seafood, and wood, are expected to uplift in the fourth quarter of this year as international demand improves. The key export products continue to benefit from the increasing value of the US dollar and reduced input costs from a year earlier.

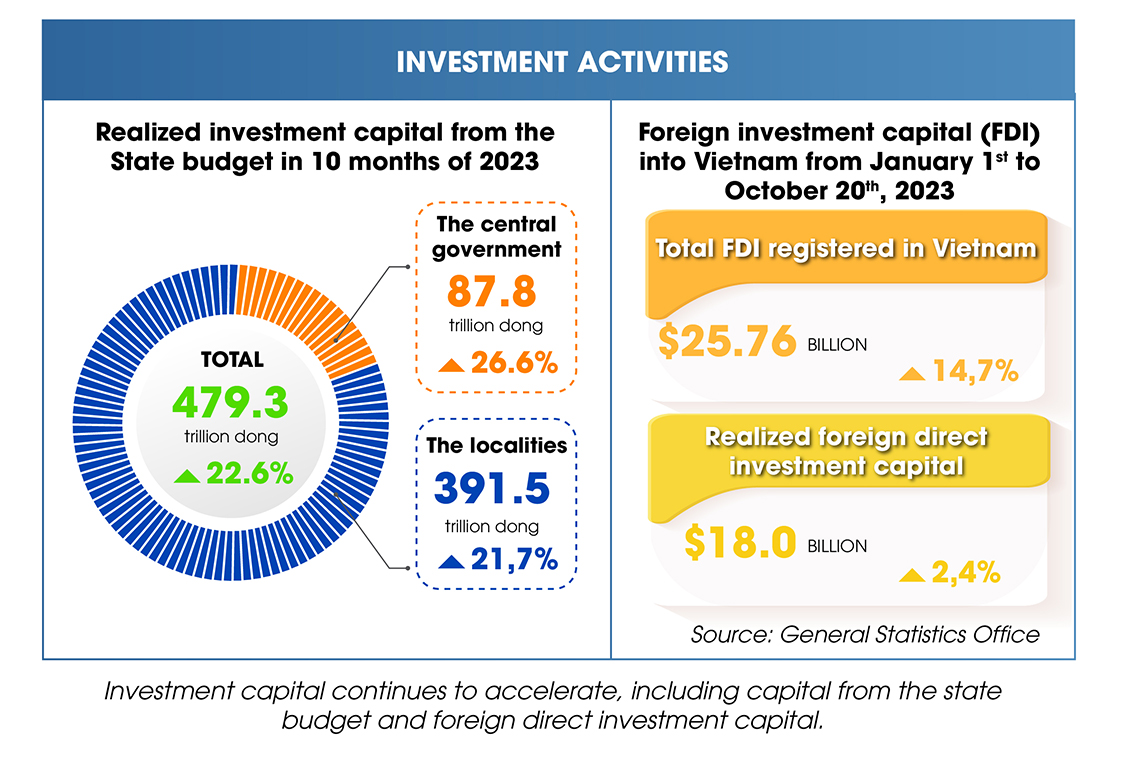

It is obvious that the flow of foreign direct investment (FDI) has soared over the past time, coupled with the increasing number of newly-opened factories across many industries ranging from petrochemicals to logistics, tire manufacturing, electronics, entertainment, consumer goods, etc.

The report updated in October shows that as of October 20th 2023, FDI capital (including newly registered capital, adjusted capital, and share purchases) reached nearly $25.76 billion, up 14.7% from a year earlier. Among them, the realized capital reached $18 billion, a year-on-year expansion of 2.4%.

In 2023, the elevation of the US-Vietnam diplomatic relationship to a comprehensive strategic partnership will drive another wave of FDI investments in Vietnam, with a focus on high-tech industries, including semiconductors. On the other hand, Vietnam will become an attractive destination for foreign manufacturing companies to be able to export to the US, according to VinaCapital.

According to a survey published in early October by the European Chamber of Commerce Vietnam (EuroCham), the Business Confidence Index (BCI) nudged up to 45.1 points in the third quarter of 2023 from 43.5 points the previous quarter, indicating that foreign investors are more optimistic about the Vietnamese market.

In fact, it is apparent that the logistics industry has had some early movements given that Vietnam is becoming an attractive destination for foreign investors.

The demand for industrial parks is expected to recover in 2024, with leasing activities predicted to jump by 20 – 25%, fuelled by many large foreign tenants in 2023. According to SSI Securities Corporation, the demand for industrial park land rental in the North records positive growth amidst the manufacturing relocation wave from China to Vietnam, mainly in the electronics and semiconductor industries. The South region will recover from a low base in 2023, mainly businesses in the export, logistics, and food and beverage manufacturing industries.

The electricity industry has been mentioned more often when the northern region experienced a power shortage for production. Continued high economic growth requires Vietnam to maintain a sufficient commercial electricity output for industrial and consumer activities. A hot topic recently mentioned that the Power Development Plan VIII has been approved. Alongside a series of investments in the renewable energy sector, the plan will lay a solid foundation for electricity demand growth in the coming period.

Generally, for the first 10 months of 2023, the total retail sales of consumer goods and services climbed 9.4% over the same period last year. This growth is lower compared to 20.8% in the same period in 2022, but it is not low.

According to experts, retail activities have slowed down as people tighten their budgets amidst the challenging economy, while companies don’t have demand to expand their businesses. However, consumer confidence is expected to rebound in 2024 due to the recovery of export orders.

HSBC’s experts assessed that the accumulation of assets is the main factor driving the gradual increase in domestic consumption in Vietnam over the past few years. It will be the key driver of consumption in the next phase, especially once consumers regain confidence and optimism in 2024. Another report by SSI shows that consumer goods manufacturing companies will continue their expansion at a slower pace.

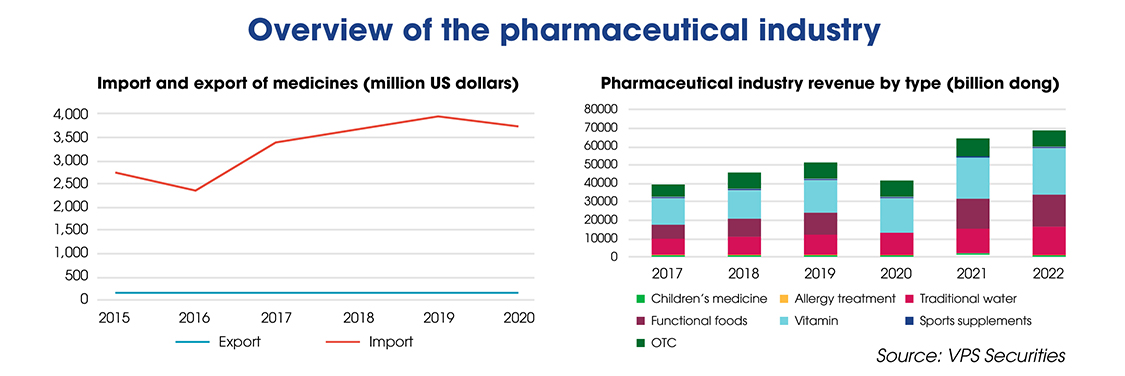

Another consumer sector under the spotlight is medicine and healthcare. Currently, numerous pharmaceutical retail companies are expanding their pharmacy chains, such as An Khang (under Mobile World), Long Chau (under FPT Retail), Pharmacity, etc.

According to Euromonitor, Vietnam is one of the most attractive markets in the region, with a CAGR of 9.2% for healthcare expenditures in the 2017 – 2022 period. Pharmaceutical companies continuously ramp up their expansion and build factories when total health care spending is forecast to reach $107.6 billion in 2031, according to a healthcare industry report published by VPS Securities in July 2023.

Since the beginning of the year, there have been a number of mergers and acquisitions by foreign investors in both the healthcare and consumer finance sectors. Therefore, the retail market will be pushed forward in the coming time.

Since the beginning of 2023 until now, sustainable development activities with a focus on the circular economic development model have been pushed forward. The National Assembly issued a resolution allowing Ho Chi Minh City to pilot a special mechanism for the development of green finance and carbon credit markets, of which Can Gio has been selected as the pilot location for development.

The Ministry of Planning and Investment is seeking comments on the draft decree on a pilot mechanism on circular economic development, testing a number of specific mechanisms to gradually build a legal framework for the circular economic development model, further moving towards the green economy. The ministry has set a goal that by 2030, 40 – 50% of localities will have plans to convert existing industrial parks to eco-industrial parks, and 8 – 10% of localities will have plans to build new ecological industrial parks.

In general, new factories have placed sustainability as an inevitable requirement. In addition to using specific technology in each field, these factories are all “specially designed” to increase environmental friendliness, aiming at Vietnam’s goal of achieving net-zero emissions by 2050.

Comment