The potential for Vietnam’s seafood exports to grow is substantial, but this path is fraught with obstacles.

Experts who recently attended the Post-Covid Seafood Market Trends and Demands Conference, organized by VASEP in conjunction with BlueScope, overwhelmingly agreed that Vietnam is benefiting from a headstart in promoting exports and expanding the fishery business. Statistics have revealed that during the first half of 2022, the global demand for seafood has recovered. Notably, Chinese consumers – a significant export market of Vietnam – has been seeking far and wide high-quality seafood products with value to offer. The United States and European markets have also exhibited a similar pattern.

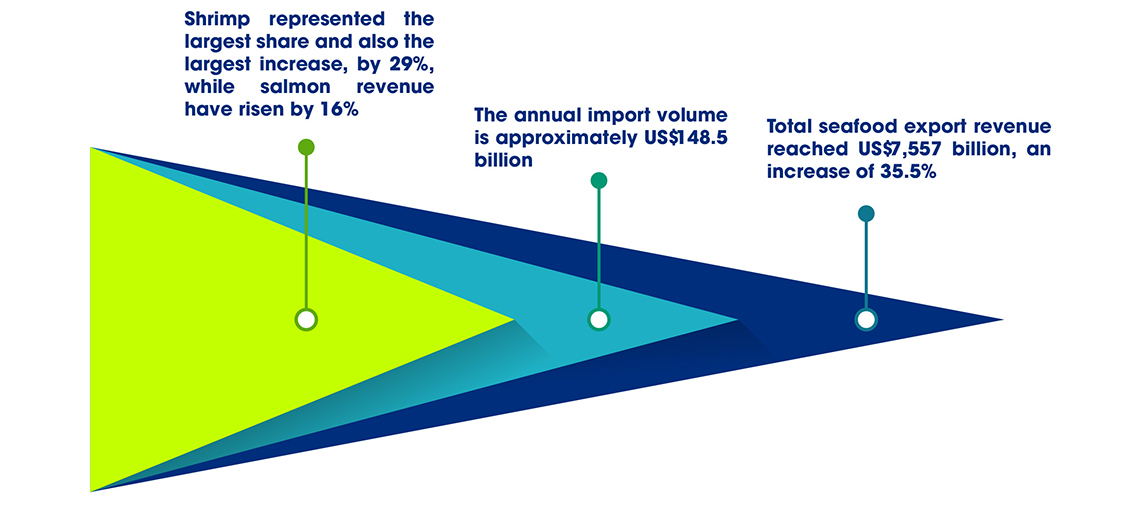

Therefore, seafood exports have constantly been accelerating since the beginning of this year. In the first eight months, seafood export totaled US$7.557 billion, up by 35.5% as compared to the same period last year. According to a report by VASEP, the global seafood market has expanded by 16% over the past five years, with an annual import turnover of around US$148.5 billion. Shrimp represented the largest share and the most significant increase, by 29%, while salmon revenue has risen by 16%.

Among the 6 largest markets, exports to China have witnessed the most substantial increase by 87% after 6 years, particularly from 2017, due to the country’s high demand for internal consumption and export processing. Last year, Vietnam exported more than US$1.1 billion to this market, while the figure in 2015 was just over US$615 million.

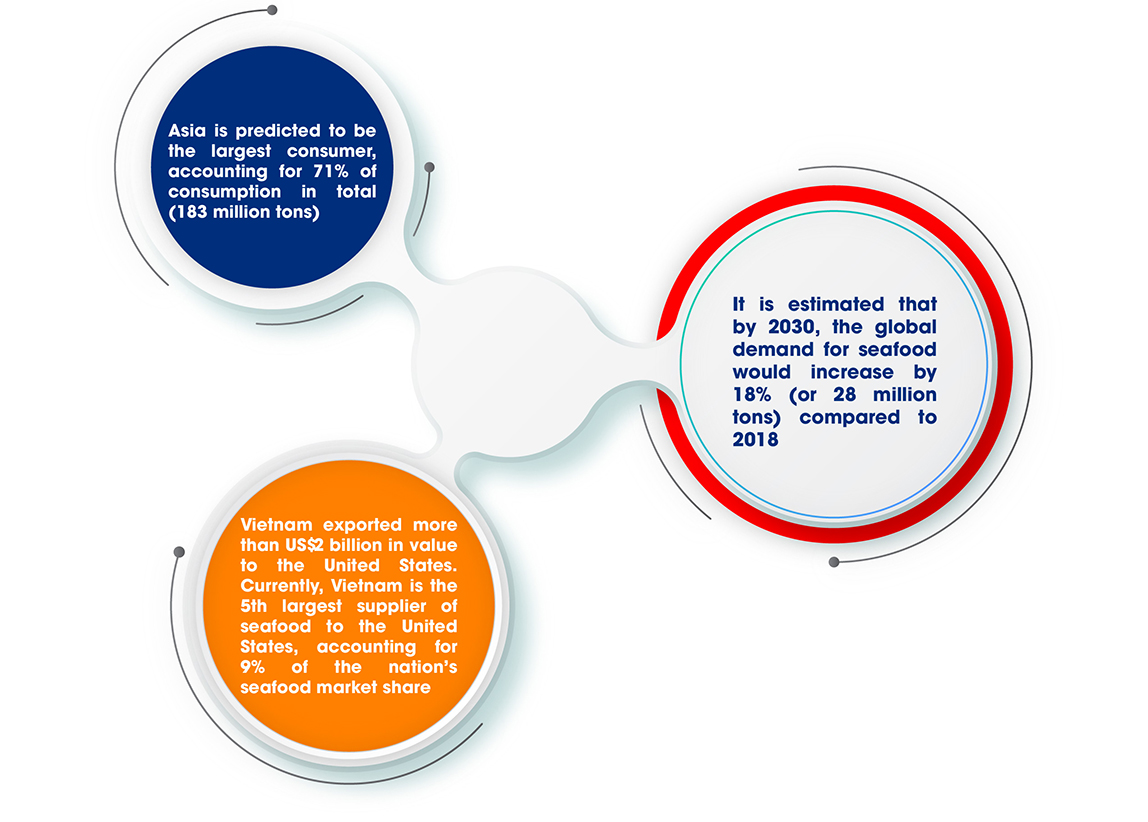

The US market followed a similar trend. After Covid-19, the market opened, the demand for all aquatic products rebounded significantly. Last year, Vietnam exported more than US$2 billion in value to the United States. Currently, Vietnam is the 5th largest supplier of seafood to the United States, accounting for 9% of the nation’s seafood market share.

It is estimated that the global demand for seafood would increase by 18% (or 28 million tons) by 2030 compared to 2018. Asia is predicted to be the largest consumer, accounting for 71% of consumption in total (183 million tons).

According to Ms. Le Hang, Director of Communications at VASEP, after two years of Covid-19, a lot of new trends in the seafood industry have emerged and had a favorable impact on the Vietnamese seafood industry.

For example, the trends of online shopping and retail are on the rise; as is the demand for moderately priced products, which is in line with the declining income level; two-way trade between bilateral and multilateral FTAs member markets has also increased; while the demand from the United States, the European Union, and China have all been witnessing rapid growth, etc.

A glorious depiction of the opportunities and future of Vietnam’s seafood industry is right around the corner. However, in reality, there is no light without shadow. Challenges and difficulties of Vietnam’s seafood industry have also been addressed in the words of both businesses and experts.

The biggest obstacle, according to Ms. Le Hang, is that the global demand for seafood has peaked and is bound to decline in the second half of 2022. Additionally, a stronger dollar shall also reduce demand in many markets, including the EU and Japan.

Along with that, the growth in

inventories causes importers to reduce their purchases and find ways to lower the pricing of imported goods. That is also the reason why seafood export prices could not remain as high as in the first half of the year.

In the forecast for seafood exports towards the end of the year, Rong Viet Securities Company (VDSC) also believes that excessive stocks, inflation, and decreased demand in the US market will face more difficulties in seafood exports to this market in the late 2022 period. However, the Chinese market could be promising in the second half of 2022, for the country has shown signs of reopening its economy.

According to Mr. Luc, the cost of transporting one container of shrimp (about 15 tons) from Vietnam to the US is about 20,000 USD, while transporting one container from Ecuador to the US would cost merely 5,000 USD. Thus, judging solely in terms of freight, one container of Vietnamese shrimp is 15,000 USD more expensive than Ecuadorian shrimp. This translates to an extra US dollar for every kilogram of Vietnamese shrimp compared to its Ecuadorian competition. This setback has also put many Vietnamese seafood exporters “in deep water.”

Logistic costs are one of the many problems that have “reduced” the competitiveness of Vietnamese seafood exports. According to Mr. Luc, the long-term demand projections for seafood will compel other nations to implement policies to encourage the shrimp industry, such as expanding cultivation, production, and processing levels, as well as marketing techniques that raise the bar for international competition. In this context, Vietnam must also invest in the seafood industry to stay ahead.

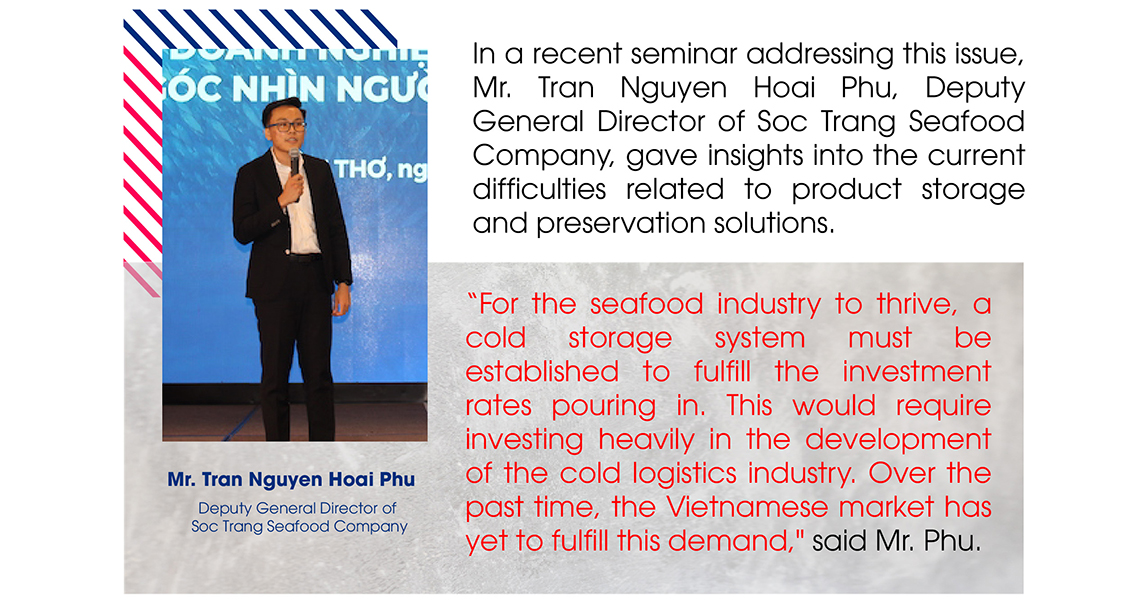

However, it is precisely deep processing that is one of the longest-standing obstacles in Vietnam’s agriculture, forestry, and fishing industries, not just the seafood business. Due to the industry’s specific characteristics, product preservation is a big problem, let alone investing in machinery and processing technology. Vietnam’s agriculture and fisheries industries continue to struggle with product preservation during the production and processing stages.

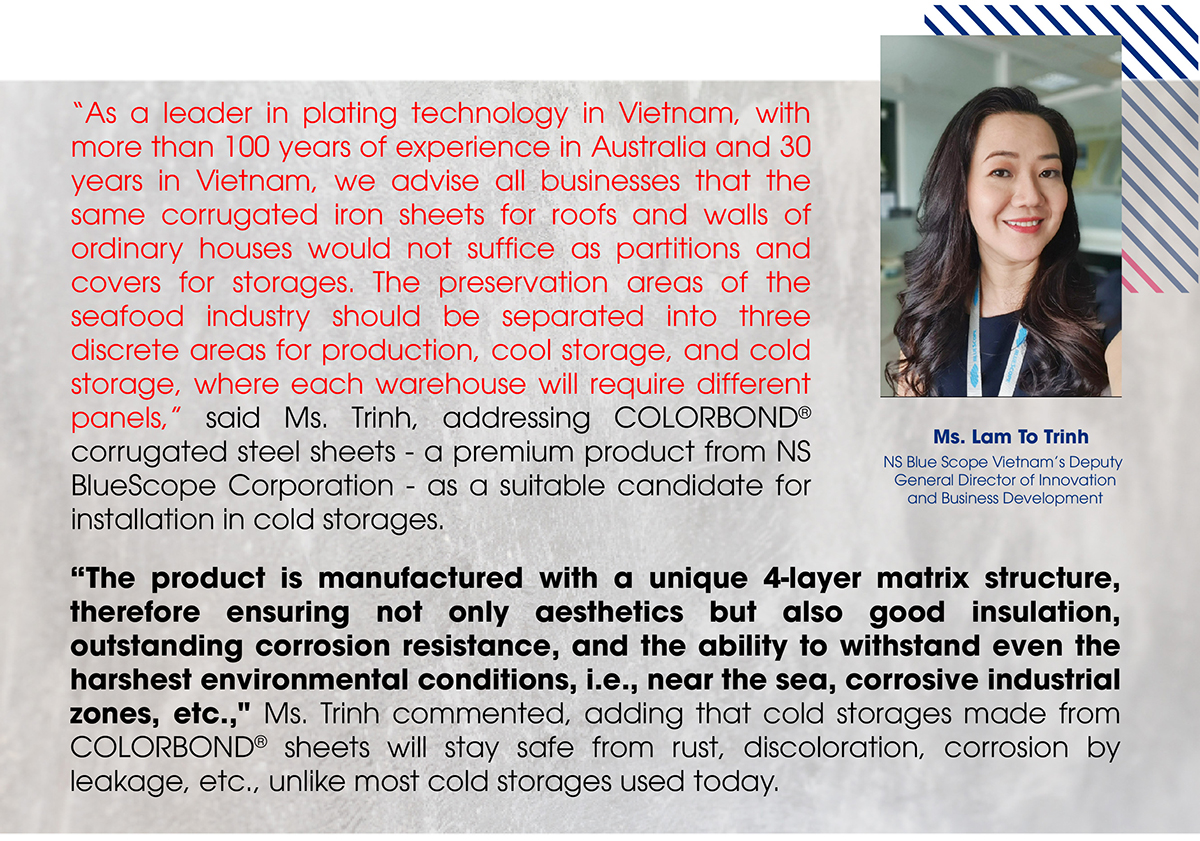

Regarding the issue above, Ms. Lam To Trinh, NS Blue Scope Vietnam’s Deputy General Director of Innovation and Business Development, noted that to solve this problem, businesses must improve production conditions to meet food hygiene and safety requirements.

Aside from the preservation dilemma, experts have asserted that for seafood export businesses to achieve a breakthrough, they must ensure sustainable orientation, transparency, traceability, responsibility, social accountability, and environmental responsibility of product production chains. This is because our target markets will soon decide to increase or enforce their current regulations on food quality, safety, hygiene, the environment, labor, etc.

Comment