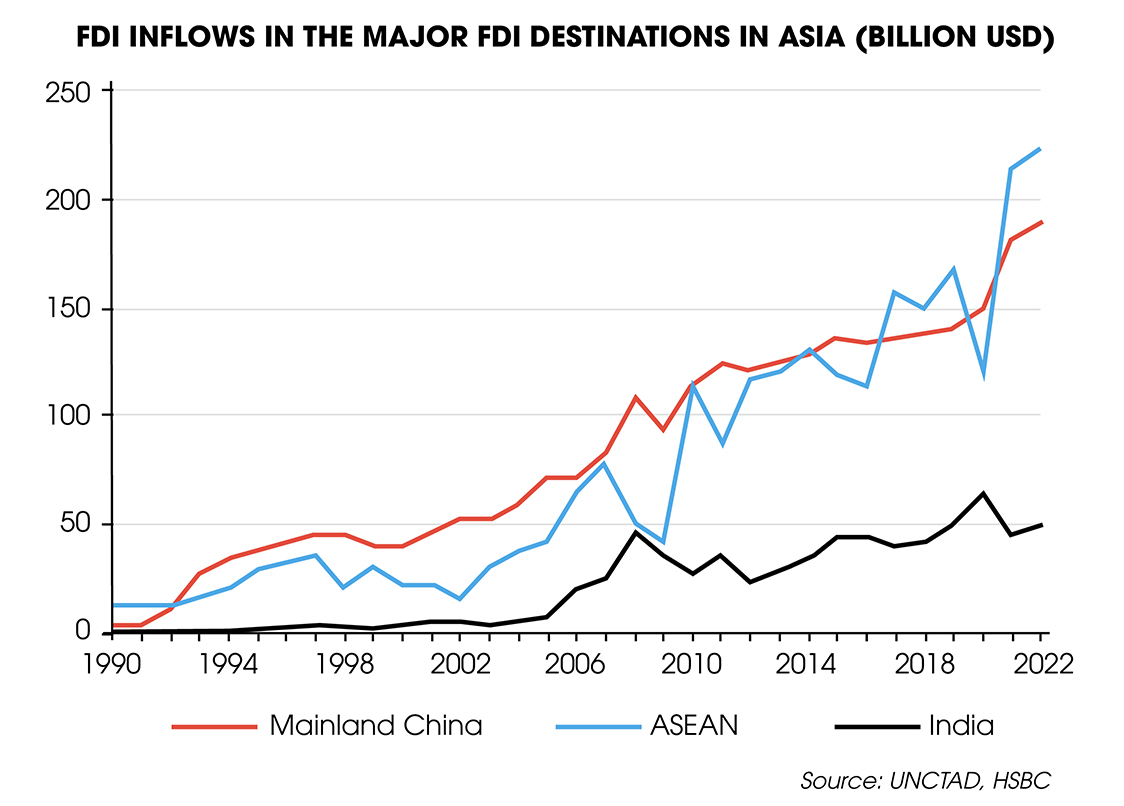

FDI inflows into high-tech industries and the shift of manufacturing out of China have increased in recent years. It is a crucial factor that shapes Vietnam’s electronics industry in 2024 and for at least the next 5 years.

Amidst global economic instability and shrinking demand, Vietnam’s export activities have plunged sharply for several months. “After rain comes sunshine,” the electronics sector, which is Vietnam’s key export industry group, is sending the first recovery signals in the third quarter. The export value of the industry group has returned to a positive growth trajectory for two consecutive months since August this year, compared with the same period a year earlier.

Although other key export industries such as textiles and garments, footwear, and timber products are struggling, items in the electronics sector record two straight months of positive growth compared with the months before, with a modest increase.

According to Mr. Frederic, Vietnam boasts a diversity of markets and products. This, coupled with a healthy growth cycle in the electronic components industry, helps the country benefit from the increasing capital flows.

In fact, after a lull period, FDI capital inflows into the high-tech industry have gradually rebounded in recent months.

In September alone, the Hai Phong economic zone authority granted licenses to 5 foreign-invested projects across many fields, from manufacturing and processing to high technology: the ECOVANCE high-tech biodegradable materials factory by SK Group (South Korea).

With a total newly registered and additional capital of over $1.2 billion, for the first time, Nghe An has risen to 6th place out of 63 cities and provinces in attracting large-scale investment projects with high technology content.

Along with Bac Giang, Bac Ninh, and Thai Nguyen, Nghe An has become the latest to join the race of luring foreign investors to pour capital to expand production and business in the electrical and electronics industry. This indicates that the demand for the electrical and electronics industry increases in quantity and expands in many localities.

In addition to the continued confidence of investors in Vietnam’s long-term development potentials (despite short-term global uncertainty), Vietnam seems to also benefit from the “China + 1” investment strategy, according to the World Bank.

Along with Singapore and Malaysia, Vietnam is also the outperformer in the tech industry.

The move to increase investments by the two companies reaffirms Vietnam’s advantages in luring FDI capital from the US. In addition, in March 2023, Vietnam welcomed the largest-ever delegation of US corporations with 50 world-renowned brands across several fields. “They are looking at Vietnam as a destination for development and opportunities,” Ted Osius, President and CEO of the US-ASEAN Business Council, said.

It is worth noting that FDI inflows into the tech industry are predicted to continue to increase in the near future, especially amidst the volatile geopolitical environment, the US-China conflict, and the elevation of Vietnam-US relations to a comprehensive strategic partnership.

According to statistics by Bloomberg, the electrical and electronics sector is the key export industry group of both Vietnam and China into the US. As China’s market share declines, Vietnam has many opportunities to fill the gap. When Vietnam rises to the top of the list of destinations for high-quality FDI capital flows into the electronics industry, this will be a crucial factor in shaping this industry in order to climb up the global supply chain. It is similar to the path China has taken for decades.

Comment