The prolonged Covid-19 pandemic in Vietnam has severely hit the supply chain. Recently, Japanese automotive companies were forced to suspend a part of their production lines due to a shortage of spare parts from Vietnam. Warnings have been given, and in fact, orders have moved out of Vietnam, which raises concerns that foreign investors may leave Vietnam…

“During 4 days, 44 trucks carrying nearly 500 tons of our consumer goods were stuck on the road”, Mr. Do Thai Vuong, Vice President of Unilever Vietnam shared the story about the difficulty in transporting goods amidst the nationwide social distancing under Directive 16 of the Prime Minister to prevent the spread of Covid-19.

According to Mr. Do Thai Vuong, Unilever Vietnam has two clusters of factories located in Ho Chi Minh City (Tay Bac Cu Chi Industrial Park) and Bac Ninh (VSIP Bac Ninh) along with 3 distribution centers in Bac Ninh and Da Nang and Binh Duong.

Despite the prolonged pandemic, Unilever’s essential consumer goods are still well consumed and thus need to be transported and distributed to many localities throughout the country. Transportation delays due to Covid-19 is unavoided, but each province requires different document and procedure: some require a negative rapid test, but others require a PCR test; even some does not accept travel declaration document issued by others, delivery trucks are allowed to pass by some localities but not by others, according to Mr. Vuong.

At the end of August 2021, Can Tho city was even be forced “to exchange cars and drivers”, causing transportation delays and supply chain disruption.

Unilever Vietnam is not the only case in this situation. Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association, once “lamented” to the Prime Minister that the inconsistency among localities had caused many difficulties for businesses.

“A textile product requires not only fabric, needle, thread but also many other auxiliary materials. However, these auxiliary materials are not considered essential goods, so businesses are not allowed to pass through the Covid-19 checkpoint.”

Mr. Vu Duc Giang,

Chairman of the Vietnam Textile and Apparel Association

“Essential goods” is the most haunting phrase for businesses in the past period. To add to that, regulations on “one road, two destinations”, “three on-sites”, and tens of thousands of workers having to implement isolation and blockade measures… have complicated the problems for businesses.

“Requiring businesses to organize ‘eat, stay, sleep’ on the spot cause businesses to incur more operating expenses. We also have difficulty replacing the number of workers who have stayed at the factory for a long time.”

Mr. Erwin Debaere,

Chief Financial Officer of Perfetti Van Melle Vietnam

It is difficult not only for companies that produce and sell goods in the domestic market but also for export companies, especially even more difficult for those that are “inputs” of the supply chain. The production disruption affects not only the domestic supply chain but also the global supply chain.

It is no coincidence that one year ago, several American companies, including Adidas, Gap, Echo Lake, Nike…, signed an application form to request the administration of President Joe Biden to support more vaccines for Vietnam. The reason is that the rapid recovery of Vietnam’s key industrial production industries thanks to the vaccine supply program will mitigate the effects of supply chain disruption in fields and industries related to the US market and businesses in particular and all over the world in general.

“Vietnam has become a key supplier of inputs to the rapidly growing US footwear industry. Therefore, our success highly relies on the health, literally, of the Vietnamese industry.”

From the letter by Mr. Steve Lamar, Chairman of the American Apparel and Footwear Association AAFA sent to the US President

Given the disrupted supply chain in Vietnam, it is understandable for businesses to find new supply sources. Mr. Vu Duc Giang said that a foreign company (Nike) did withdraw more than 100 million orders from Vietnam.

Meanwhile, according to a recent survey by EuroCham, 18% of enterprises in the manufacturing industry have partially shifted their production orders or demand to other countries, while 16% of businesses are considering this option.

Of course, according to Mr. Alain Cany, President of EuroCham, this is mainly “transferring orders and is a temporary decision”, and “as at now no European enterprises have left Vietnam”. However, worries over “the loss of orders and losing investors” have become an existential concern, as the Covid-19 pandemic in Vietnam has not yet to be contained.

In a recent sharing in Ho Chi Minh City, Ms. Ho Thi Thu Uyen, Director of External Affairs at Intel Vietnam, along with a series of difficulties faced by businesses in the time of “social distancing”, expressed concern that “foreign capital may flow out of Vietnam if the social distancing is prolonged”.

Meanwhile, Jabil Vietnam Company also said that many partners have moved orders to other countries, such as China, Singapore, etc. because the company was unable to meet the progress of customers. “If the situation continues for a long time, we will have to reduce our operation in Vietnam,” said a representative of Jabil Vietnam

And that is a fact. Minister of Planning and Investment Nguyen Chi Dung is one of those who understands this very well. In recent reports to the Government, he always emphasized the risk that investors will move production to other countries.

In the first eight months, Vietnam attracted over $19 billion in foreign investment, down 2.1% over the same period last year. Apart from declining global investment flows, or selective investment attraction policies, the prolonged entry restriction, and isolation policy have slowed down experts and project development teams into Vietnam to survey and carry out investment procedures, which was mentioned as one of the main reasons.

Not to mention, Minister Nguyen Chi Dung also said that the blockade of factories and restrictions on the movement of workers in industrial zones halted production, reduced capacity, and output, and disrupted the supply chain, which has also affected the operation of existing projects, and negatively affected the psychology of potential investors who are planning to invest in Vietnam.

“Due to factory closures and labor shortage for production, many orders had to be moved to other areas in the supply chain. Although this is only a temporary solution, if this situation is prolonged, investors will likely move production to other countries.”

Nguyen Chi Dung,

Minister of Planning and Investment

Alain Cany also mentioned that if the social distancing continues in localities for another 2-3 months or longer along with the lack of vaccines for workers, the supply chain is disrupted and the pandemic is not contained, the departure of foreign enterprises is “probable”.

In fact, up to now, although no enterprises have yet left, new investment plans have been delayed. Exxon Mobil once proposed to delay the Blue Whale mining project and other projects in Vietnam. Apple and Google are not in a hurry to move production from China to Vietnam due to the pandemic.

Earlier this year, Foxconn, Apple’s largest outsourcing manufacturer, announced an investment of $270 million to build a new factory in Bac Giang, specializing in the production of Macbooks and iPads. However, this plan is being delayed due to the pandemic and incomplete supply chain.

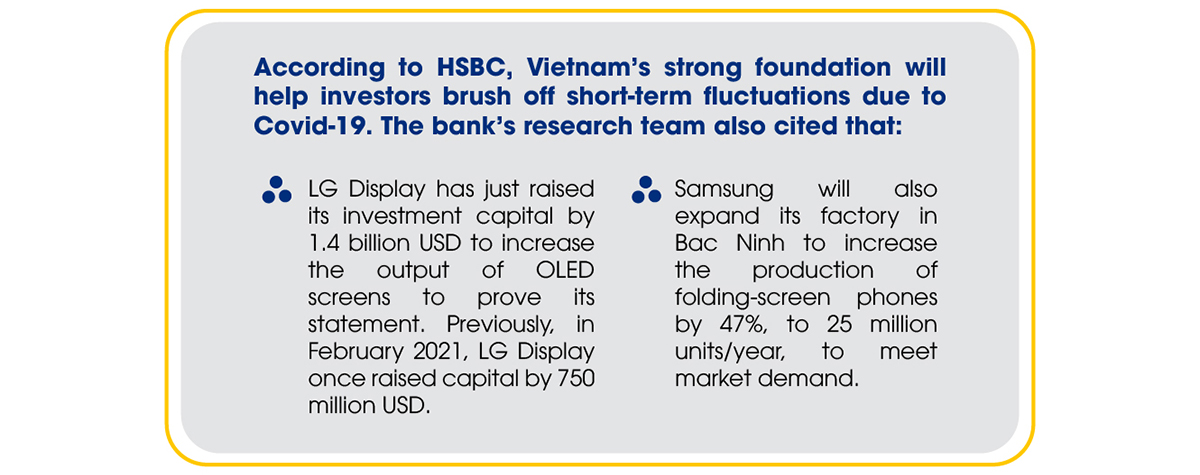

The impacts are real and so does the risk of investors leaving. However, there are still optimistic views on this situation.in a recently released report, HSBC Bank has commented that: “Despite possible challenges, Vietnam remains an attractive destination for investors in the coming time”

Mr. Julien Brun, General Director of CEL Consulting, said that although factories in

Vietnam are currently stuck, the difficulties are only temporary. Moreover, at present, the problem is not only present in Vietnam, but factories in Asia, especially Southeast Asia are also affected by the outbreak.

China is mentioned by Mr. Julien Brun, but at the same time, he also said that “no enterprise at this time is moving the production chain from Vietnam to China”.

“Apparel brands like Nike or Adidas will also have to wait. It is unlikely that Vietnam’s competitiveness will be affected unless the epidemic lasts for another 1-2 years.”

Mr. Julien Brun,

General Director of CEL Consulting

Ms. Nguyen Phuong Linh, Deputy Director of Control Risks Consulting Company also has a similar view. According to Ms. Linh, currently, restrictive measures are holding back Vietnam’s production capacity. However, the production shutdown is only a short-term problem and the reason is that “Vietnam is still an attractive destination compared to many other countries in Asia”.The reviews are positive. But most importantly, it is the recent moves of the Government of Vietnam.

Good news in Vietnam

Comment