The food and beverage (F&B) industry experienced a recovery in the first nine months of 2023 and has been on a strong recovery in the last three months. F&B companies are bolstering investments in sustainable manufacturing, digital transformation, and innovation to keep up with the development trends of the market.

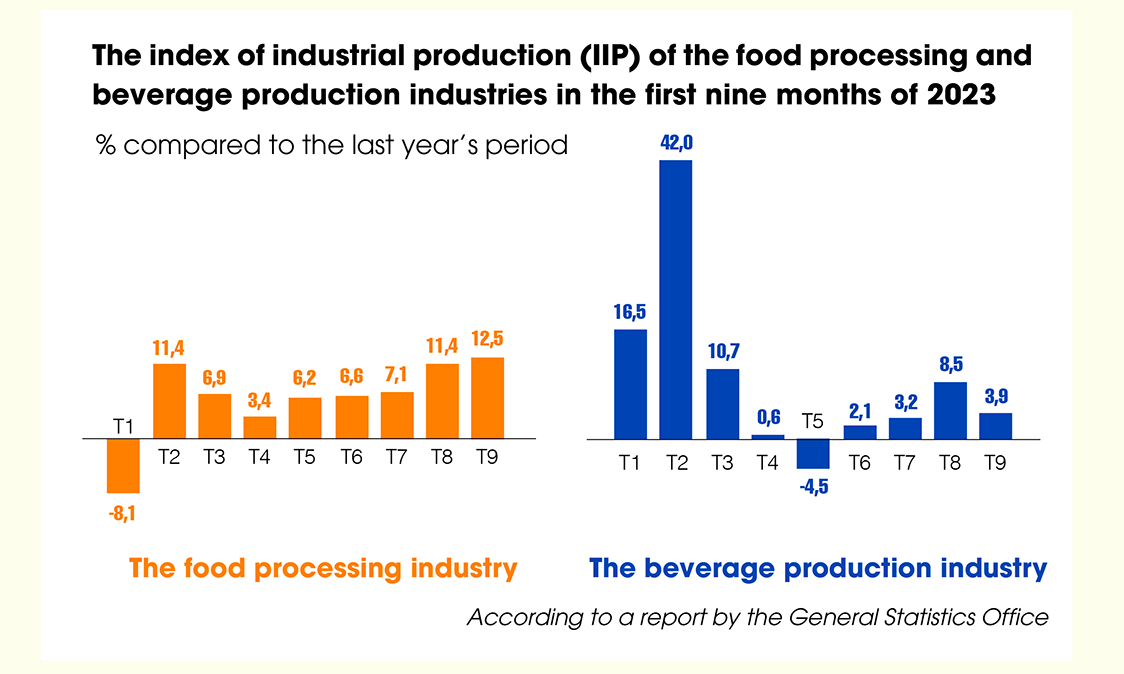

According to a report by the General Statistics Office, the index of industrial production (IIP) of the food processing and beverage production industries increased by 5.8% and 3.9%, respectively, in the first nine months of 2023. The IIP has posted a recovery since the end of the second quarter.

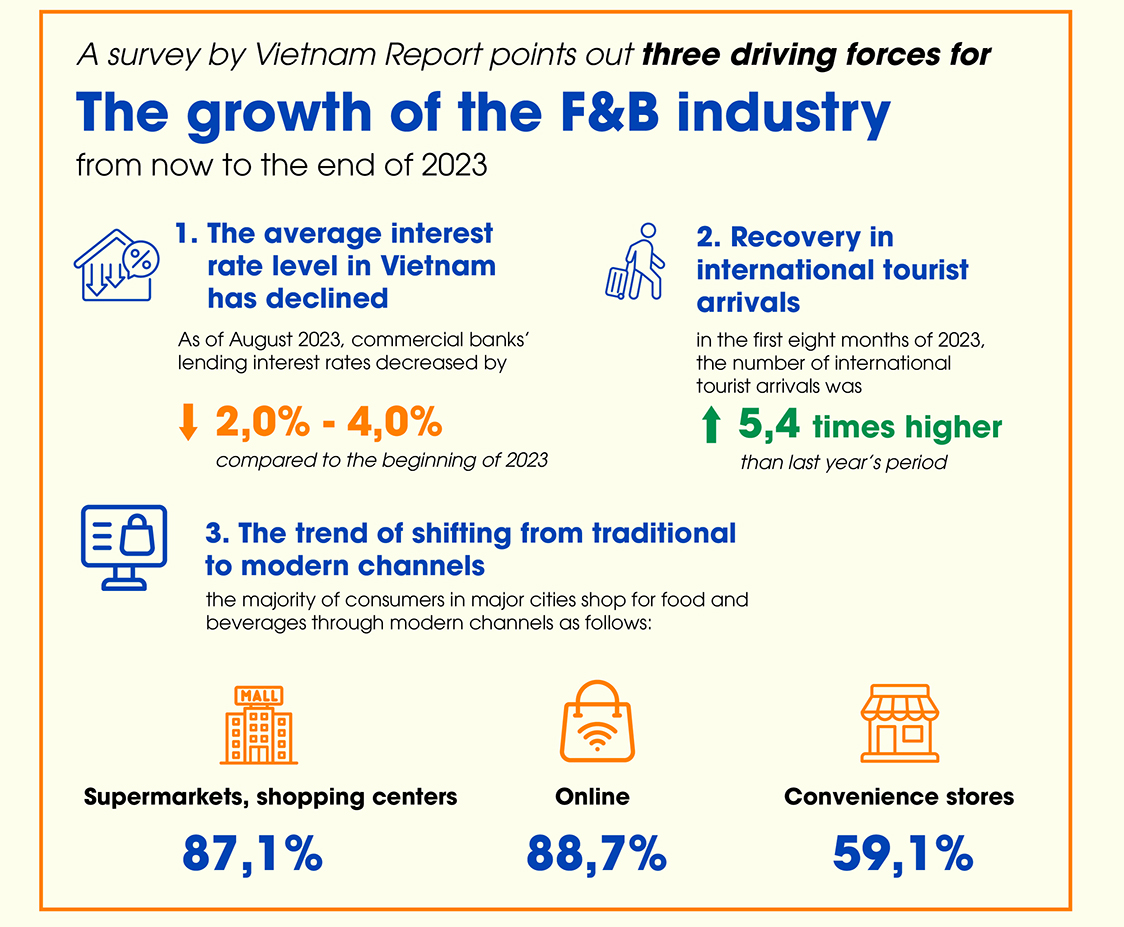

A survey by Vietnam Report points out three driving forces for the growth of the F&B industry from now to the end of 2023. First, the average interest rate level in Vietnam has declined following the government’s efforts to slash operating interest rates four times in a row. Therefore, F&B businesses can reduce loan expenses and get better access to capital, thereby boosting production activities and developing distribution channels.

Second, there are signs of recovery in international tourist arrivals, making an important contribution to the growth of the F&B industry. According to a report by the General Statistics Office, in the first eight months of 2023, the number of international tourist arrivals was 5.4 times higher than last year’s period but still equal to 69.2% compared to the same period in 2019.

Third, the trend of shifting from traditional to modern channels continues to be a growth driver for businesses in the industry. The consumer survey by Vietnam Report shows that the majority of consumers in major cities shop for food and beverages through modern channels as follows: Supermarkets, shopping centers (87.1%), Online (88.7%), and Convenience stores (59.1%).

Most businesses are more optimistic about the outlook of the F&B market in the remaining months of the year than at the beginning of the year. However, this rate decreased significantly compared to the previous year, from 94.4% to 61.6%, according to the Vietnam Report.

Optimistic signals for the upcoming improvement in the F&B industry also come from the financial situation of consumers. The consumer survey by Vietnam Report for the F&B industry 2022 shows that 57% of consumers anticipate a slight improvement in their family income, and 30.6% expect a significant increase in the next 12 months.

The recovery in consumer income, coupled with the solution of a 2% VAT reduction to stimulate demand, will make an important contribution to the upcoming growth of the F&B industry during the year-end spending season.

Sustainable development, digital transformation, and innovation are the top concerns of F&B companies in order to adapt to the volatile market. The F&B firms have stepped up investments in these three areas and announced large projects in recent times.

The F&B industry is characterized as resource- and carbon-intensive. The industry is under pressure on sustainable development from many sides: retail and commercial customers (restaurants, supermarkets, etc.), shareholders, and investors. They all require F&B firms to develop sustainably.

In light of this trend, F&B companies have bolstered investment in sustainable manufacturing.

Coca-Cola Beverages Vietnam Ltd. is building a green factory in Long An with a total investment of $136 million. The factory has been designed to minimize the impact on the environment and save water and raw materials by using clean energy.

Vinamilk has replicated the model of installing solar energy systems on the farm chain and factories. Presently, 13 Vinamilk farms and 10 of its factories have been completely outfitted with solar energy. At the same time, the company also promotes green energy sources such as Biomass, CNC, and Biogas.

Digital transformation is an inevitable step for the F&B industry to quickly adapt to market changes quickly and improve competitiveness.

iPOS.vn’s survey found that 82.8% of F&B companies embarked on digital transformation, mainly deployed in sales activities and warehouse and raw material management.

Nestlé Vietnam currently deploys smart applications for warehouse and transportation management. The company has been digitizing its freight center system, changing operations in terms of receiving orders, allocating transportation, operating warehouses, and tracking delivery to customers.

Similarly, Heineken has made serious investments in digital transformation. The company applies technology across its value chain, from manufacturing to delivery to customers. For instance, all of Heineken Vietnam’s breweries adopt technology solutions for end-to-end process optimization, the Internet of Things (IoT), and Artificial Intelligence (AI).

In Vietnam, the F&B industry records a high growth rate. Therefore, innovation will inspire businesses to keep up with the fast-paced development in the market. The list of the Top 10 Innovative and Effective Enterprises in the Food – Beverage Industry in Vietnam in 2023 by VietResearch shows that F&B companies such as Vissan, Vinamilk, Masan Consumer, and IDP are all implementing innovation activities.

In July 2023, Bloom., developed by Tetra Pak in partnership with DenEast, was officially put into operation in Binh Duong. It is Vietnam’s first-ever global innovation center for the F&B industry.

Bloom. is designed to help F&B companies expedite product innovation processes by converting ideas into tangible concepts.

In early 2023, Swire Coca-Cola, a wholly owned subsidiary of Swire Pacific Ltd., announced the completion of its acquisition of Coca-Cola Beverages Vietnam Ltd., the Coca-Cola bottling subsidiary in Vietnam.

In the first half of 2023, Swire Coca-Cola reported revenue of VND 5.499 trillion from its Vietnamese business, equaling VND30 billion per day. Among the company’s markets, Vietnam ranked third in revenues behind the US and mainland China.

Likewise, Suntory PepsiCo Vietnam Beverage Company has invested an additional $38.8 million in its factory in Can Tho to build new production lines for purified water and tea. After various adjustments, the registered capital has been raised to nearly VND1.63 trillion, equaling $70.8 million.

According to Bloomberg, Growtheum Capital Partners, a Singapore-headquartered private equity firm, has agreed to pay around $100 million for a 15% stake in Vietnam’s International Dairy Products JSC (IDP) as it looks to tap the region’s growing dairy market.

With strict food safety standards, many large projects in the F&B industry have prioritized the use of sustainable materials. One of the top choices for building F&B factories is steel solutions from NS BlueScope Vietnam.

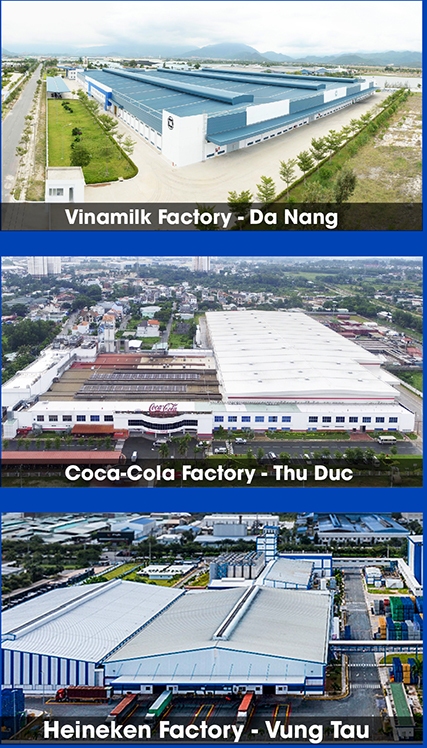

Specifically, NS BlueScope Vietnam’s products have been present in many large FDI projects in the F&B industry, such as the Nestlé factory in Bien Hoa industrial park, the Coca-Cola factory, the Heineken brewery, etc. In addition to FDI enterprises, local giants in the F&B industry, like Vinamilk, also put their trust in COLORBOND® steel.

Comment