In the “heating” FDI race, great opportunities to acquire the ongoing investment capital flows shall be missed if Vietnam is not “faster” and takes breakthrough solutions even though Vietnam’s potential and advantages are highly appreciated.

“Although similar incentives are applied by Vietnam and Singapore, we shall successfully acquire the projects thanks to our abundant natural resources, large market, high economic performance, and smart leadership”, shared to Bloomberg by Mr. Nurul Ichwan, Indonesian Investment Coordination Board.

Players such as Amperex, LG Chem, or Tesla are actively motivated to attract FDI as battery and electric vehicle manufacturers, the “hot” trend in the 21st century, are being targeted by Southeast Asia’s biggest economy.

Meanwhile, it was unveiled that a new tax policy issuance plan was released by the Philippines two weeks before. It was “inspired” by Singapore and focused on reducing Corporate Income Tax (CIT) from 30% to 25% for giants and 20% for SMEs. In such an effort, a series of renovations were continued by the country, covering additional empowerment to the President in offering non-financial incentives to the enterprises and coordinating the operation of 13 investment promotion agencies independently operated.

All of such moves aim to take ahead of powerful FDI flows in the context that Covid-19 pandemics are extremely complicated, resulting in a series of groups speeding up the diversification of their non-China supply chain strategy.

Not only Indonesia or the Philippines, but a series of measures are also actively launched to attract FDI by Thailand, Malaysia, even Laos, and Cambodia. Thailand has been recognized as one of the players who are fastest in launching a myriad of FDI attraction policies in 2 recent years, including the “Thailand Plus” policy. Accordingly, a reduction of 50% of the next five-year CIT is applied to large-scale projects in the key industries.Foreign Direct Investment (FDI) race in ASEAN is “hotter” than ever!

The FDI race in ASEAN is also being sped up by Vietnam. Even for over one year since the Covid-19 global outbreak, Vietnam is always highly appreciated and considered as a safe and attractive destination, an ideal option for groups looking for supply chain diversification.

Great success in Covid-19 prevention makes Vietnam become a good choice. The South China Morning Post (China) recently judged that Vietnam is regarded as one of the alternative options for China in the region as released from a survey. Vietnam’s position was successfully maintained in the challenging year 2020. At the beginning of 2021, Vietnam was honored to be the world’s leading supply market voted by 25% of international business respondents.

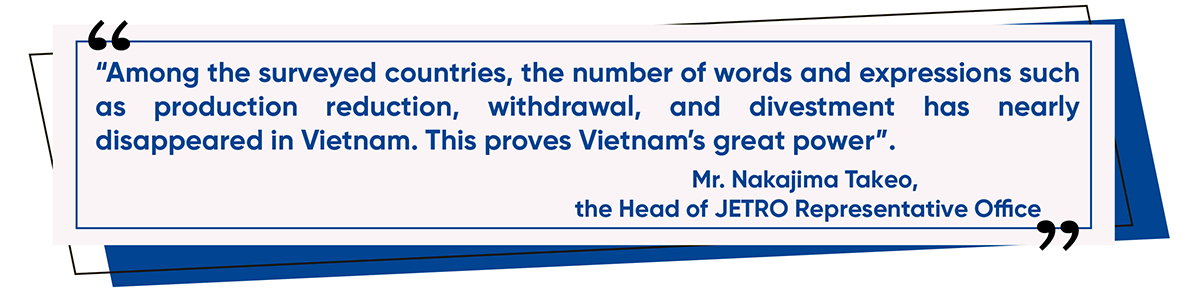

Meanwhile, Mr. Nakajima Takeo, Head of JETRO Representative Office in Hanoi, unveiled that production and business expansion are very hard as referred to by the JETRO survey on investment and business trend in 1-2 next year. Nevertheless, Vietnam is still named of the TOP countries of ASEAN.

In fact, Vietnam is being funneled as an FDI capital. However, from an equal perspective, it seems that FDI into Vietnam is not developed as expected. In 2020, Vietnam was recorded with US$28.5 billion of FDI, reducing 25% against the last year. The figure in the first four months of this year was US$12.25 billion, accounting for 99.3% compared to the same period of 2020.

By evaluating this disclosure, Mr. Do Nhat Hoang, the General Director of Foreign Investment Department (under the Ministry of Planning and Investment) assumed that this is a positive outcome in the context of global FDI deduction.

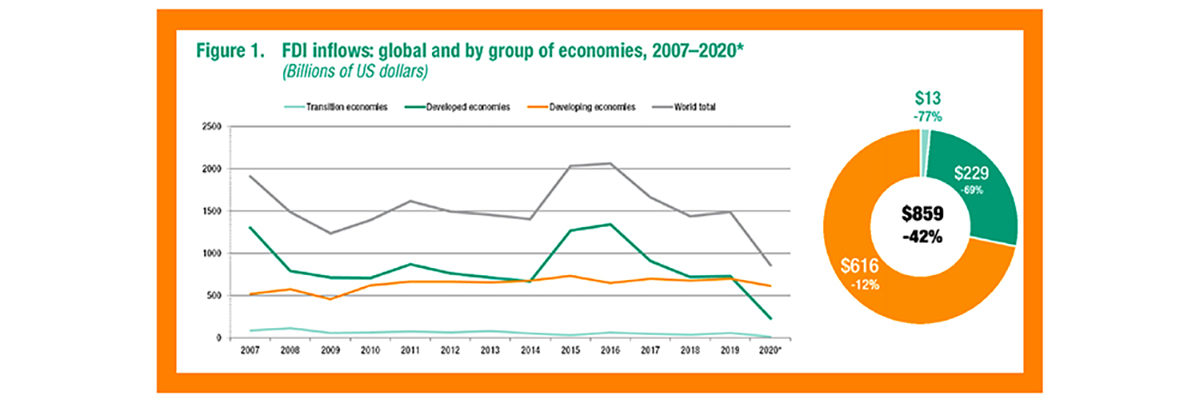

UNCTAD unveiled that the global FDI climbed down to 42%, just US$859 billion against US$1,500 billion in 2019. FDI into ASEAN reduced by 31%. With such a perspective, FDI attraction into Vietnam was still promising.

In the manufacturing division, a myriad of big investors also enhanced their investment and business activities in Vietnam. Among them, a tablet and laptop production and fabrication project launched in Bac Giang by Foxcom, characterized by the registered capital of US$270 million. The US$200 million projects were also launched in Nghe An, Vietnam, by Everwin Precision Technology Co., Ltd.

This judgment is recently further enhanced by critical moves of the giants. For example, SK Group (Korea) signed an agreement with Masan Group to reacquire 16.26% shares of VinCommerce that was held by such an entity, worth US$410 million. Alternatively, Sumitomo Mitsui Group announced to spend US$1.37 billion to acquire 49% of FE Credit through SMBC.

Moreover, Intel Group has expanded its investment up to US$475 million and planned to launch investment phase II. LG Display’s capital was also increased to US$750 million. Meanwhile, the well-known giants such as Foxconn, Luxshare, Pegatron, Winstron, etc., were recognized with ceaseless effort in financing Vietnam. Recently, AT&S Group (Austria) also visited Vietnam to launch the survey on a US$ 1.8 billion hi-tech project site.

However, the question is that Vietnam being short of breath in the FDI race.

In the early of this year, an interesting shock was presented when the global investment figures were released by UNCTAD. Regardless of reduced global FDI and contrary to any forecasts that FDI is escaping from China, the world’s second-largest economy was still named on the first rank in terms of FDI, exceeding the USA. In 2020, China was recorded with US$28.5 billion of FDI capital, an increase of 4% compared to last year.

Meanwhile, Indonesia BKPM unveiled that total realized investment capital in Q1/2021 hit 219,700 billion rupiahs (US$ 15.1 billion), up 4.3% compared to the same period of last year and an increase of 2.3% compared to Q4/2020.

Any comparison was relative as China was the World’s second-largest economy and even when the groups cannot be separated from the world’s biggest supplier. While Indonesia was the ASEAN’s largest economy, obviously, FDI into Vietnam was reduced, markets still climbed up. And this was noteworthy., and such

The concern was reported to the Government by the Minister of Planning and Investment to some extent that FDI flows in Vietnam are reduced.

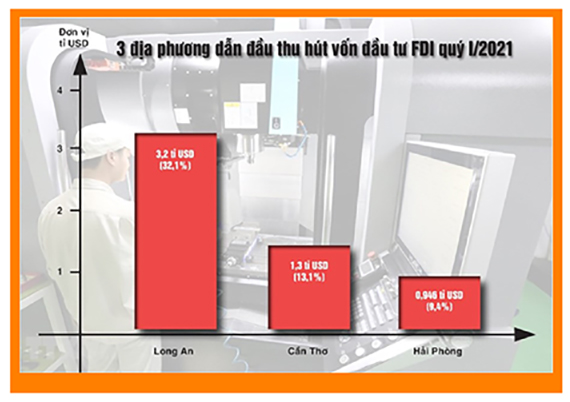

In the first four months of the year, FDI into Vietnam was similar to that in the last year. It was largely compensated by big projects such asUS$3.1 billion Power and Gas Project in Long An, O Mon 2 Thermal Power Plant, US$1.31 billion projects in Can Tho, or US$750 million capital increase project of LG Display Hai Phong. In fact, in terms of quantity, turns of newly registered projects in the last 4 months reduced 54.2%; the turns of projects for capital reduction was 21.5% and the turns of capital contribution projects reduced 64.1% compared to the same period.

-> The foreign investment capital flow into Vietnam was seriously affected by Covid-19 pandemics.

The global FDI is forecast to continue decreasing by UNCTAD, even though it hit the bottom this year. The situation may be only improved by 2022 and the reasons still originated from uncertainty on Covid-19 pandemic development. This is unveiled by the recent Covid-19 outbreak in India and its complicated pandemic development in Vietnam in recent weeks.

When the “cake” piece is not increased or even smaller, the FDI attraction competition shall be much more cut-throat. If a good preparation is not made even though Vietnam is characterized by a series of advantages and great chances from the “China + 1” trend, the opportunities to become a new Southeast Asia production center shall be missed…

The investment capital flow is not available as we take it for granted as repeatedly emphasized by Minister Nguyen Chi Dung. Although the Vietnam Government has made a great effort to go ahead and take the transient investment capital flow from preparing for land, energy source, manpower, etc., it seems that all of the things are not developed as expected.

At the end of August 2018, Politburo issued Resolution No. 50/NQ-TW on orientation to perfecting the legislation and policies to improve the foreign investment quality and performance to 2030. In April 2020, the Government promulgated Resolution No. 58 to implement Resolution No. 50/NQ-TW with specific tasks assigned to the ministries, industries, and localities.

Unfortunately, up to now, many tasks have not been completed yet, from developing the future FDI attraction strategy to launching new incentives or supplementing incentive mechanisms for the effective operation of businesses, outperforming the obligations and commitments, etc.

The greatest point is that the amended Law on Investment has promptly been adopted with special terms on investment privileges for large-scale projects, high technology projects, and R&D investment projects. However, an official resolution on this matter is still looked forward to by the Government.

Currently, the draft Decision on Special Investment Privileges is being perfected and submitted to the Government for approval. “The draft Decision specifies 4 criteria to identify whether the businesses are applied with special preference. It includes high technology, technology transfer and percent (%) of Vietnamese players involved in the domestic production chain and value”, shared by Mr. Do Nhat Hoang.

If the draft Decision is early ratified by the Government, it shall be a great push for the powerful investors such as Foxconn, AT&S, Intel, etc., to push up their investment plans and accompany other “eagles” to nest in Vietnam.

Not only policies, but a factor highly concerned by the foreign investors are also human resources. Particularly, this transit strength is recognized in high technology projects.

Comment