The number of rich and super-rich individuals in Vietnam has been rapidly increasing in recent years, despite the impacts of the COVID-19 pandemic. This makes Vietnam an increasingly attractive destination for luxury brands.

“With the opening of Gran Melia Nha Trang, we have raised the Melia brand’s standards in Vietnam,” said Mr. Andre Philippe Gerondeau, the Chief Operating Officer (COO) of Melia Hotels International.

Gran Melia Nha Trang is not the only luxury hotel entering Vietnam recently. After a series of renowned brands such as InterContinental Danang Sun Peninsula Resort, Six Senses, and Amanoi, IHG Group introduced the 6-star hotel brand Regent to Phu Quoc at the beginning of last year, despite the serious impact of the pandemic on tourism. This is the first Regent Hotels & Resort in Vietnam that offers a level of service surpassing traditional luxury standards.

Last year, IHG also collaborated with Sun Group to introduce IHG’s latest luxury brand, Vignette Collection, to Vietnam. This new brand will begin with a two-resort-villa project, Sun Onsen Village in which Sun Group has invested in Quang Ninh.

“I am confident that the concept and the health-focused onsen resort experience offered by Vignette Collection will set new standards for the hotel service industry in Vietnam,” commented Ms. Serena Lim, Vice President in charge of Development at IHG for Southeast Asia and South Korea.

In addition to these renowned brands, information shared by Ms. Hoang Dieu Trang, Senior Manager of Commercial Leasing at Savills Hanoi, suggests that the Hanoi market is soon to welcome luxury hotels such as Four Seasons, Fairmont, Waldorf Astoria, and more.

“All of these developments will contribute to the creation of new luxury shopping complexes in the capital market, attracting high-end brands to enter this market full of potential,” shared Ms. Hoang Dieu Trang.

In addition to these well-known luxury brands, high-end retail brands for jewelry, watches, fashion, and more have also been establishing a presence in Vietnam, like Dior, Louis Vuitton, Tiffany & Co, Christian Louboutin, Tory Burch, Omega, and others. These stores have consistently welcomed a significant number of customers during this time, despite the economic challenges.

While Vietnam may not yet be on par with leading luxury markets like France, Europe, Hong Kong, and China, it is emerging as an attractive destination for the luxury industry. According to Statista, Vietnam’s luxury industry is projected to generate approximately US$ 957.2 million in revenue in 2023, with an expected annual growth rate of 3.23% until 2028.

Nick Bradstreet, Director of Retail at Savills for Asia-Pacific, notes that in the two emerging markets of Vietnam and Thailand, the former is receiving more attention from luxury brands due to positive economic developments, an increasing number of high-income individuals, and the shopping habits of the emerging middle class regarding luxury goods.

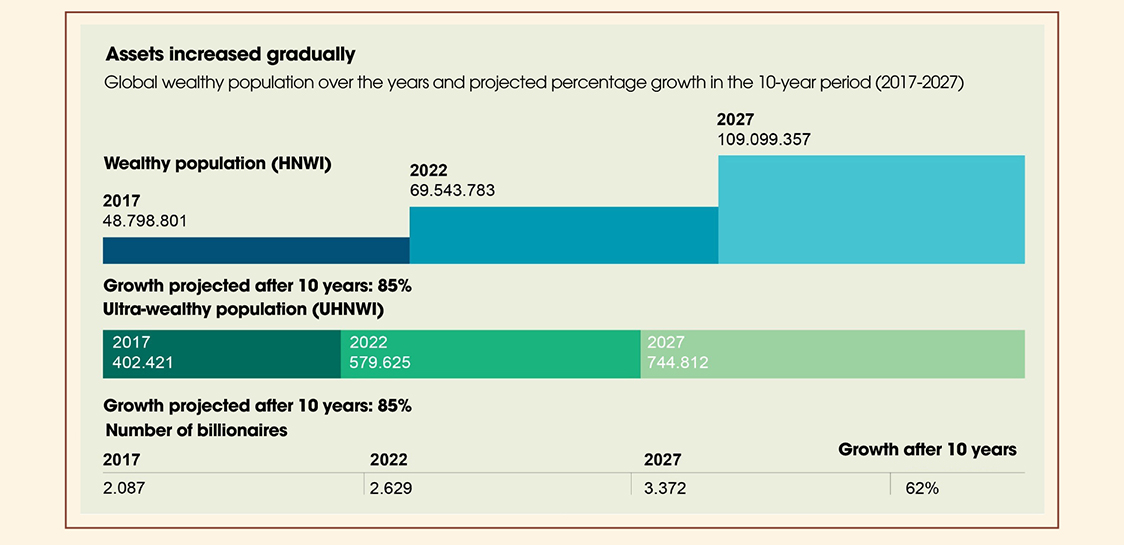

A recent Knight Frank Prosperity Report indicates that the number of super-rich individuals in Vietnam nearly doubled from 2017 to 2022. According to Knight Frank, the end of last year saw the number of individuals with a net worth exceeding US$30 million (more than VND700 billion) reach 1,059. The projection indicates that by 2027, this number will almost reach 1,300, equivalent to a 122% increase over 10 years. Furthermore, the population of the wealthy who are individuals with assets of US$1 million or more, has increased by 70% over the past five years and is projected to surge by 173% within a decade from 2017 to 2027. These factors have drawn significant attention from luxury brands in Vietnam.

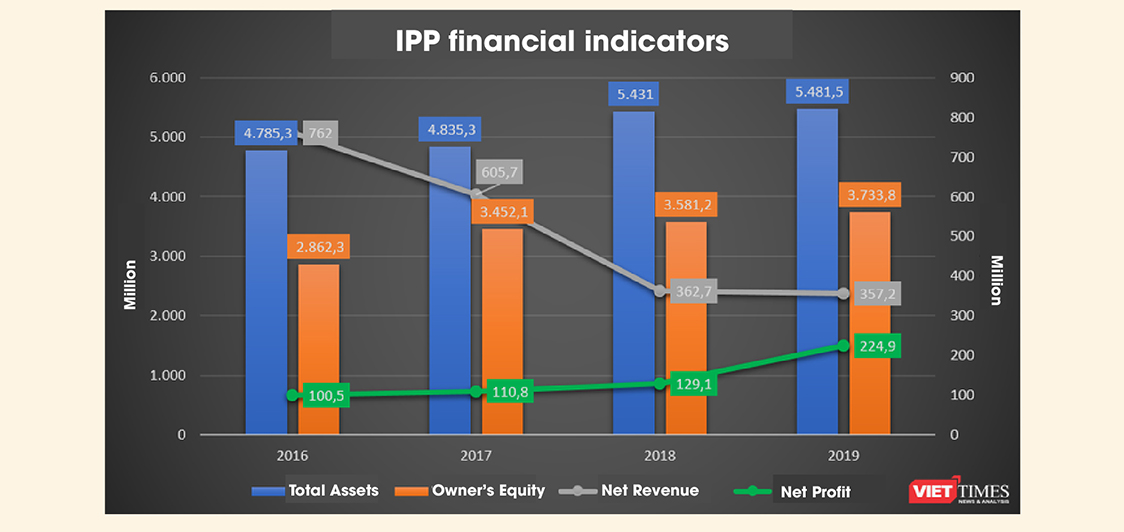

Businessman Jonathan Hanh Nguyen, Chairman of the Imex Pan Pacific Group (IPPG), is often referred to as the “king” of luxury brands. IPPG holds exclusive distribution rights for over 100 fashion brands in Vietnam, including Christian Louboutin, Burberry, Dolce&Gabbana, Rolex, Cartier, Salvatore Ferragamo, and Versace. Last year, despite economic challenges, IPPG Fashion, the unit responsible for luxury business within IPPG, still saw a remarkable revenue increase of 64%, reaching a total of VND 5,132 billion. As a result, IPPG Fashion achieved pre-tax profits of VND423 billion, equivalent to an average of over VND1.1 billion per day. This is the highest profit level ever achieved by the luxury business segment.

The business results of IPPG somewhat illustrate how the luxury industry can be a “golden goose” for savvy entrepreneurs who grasp the opportunities of the moment. Jonathan Hanh Nguyen is certainly not the only one in this regard. KDI Holdings, led by the “giant” Kieu Huu Dung, is another example.

Not limited to Nha Trang, and not just within the tourism industry, an increasing number of luxury brands are turning their attention to Vietnam, a market full of potential. While the scale may not be as significant as in more established luxury markets, Vietnam is poised to become the next destination for the global luxury industry.

Comment