Reshaping global supply chains along with the “greening” concept has led to a drastic change in the logistics industry. As Vietnam is expected to be a beneficiary of this trend, the country is in transition to its next stage of development. This can be clearly seen in the four smaller trends taking place in Vietnam.

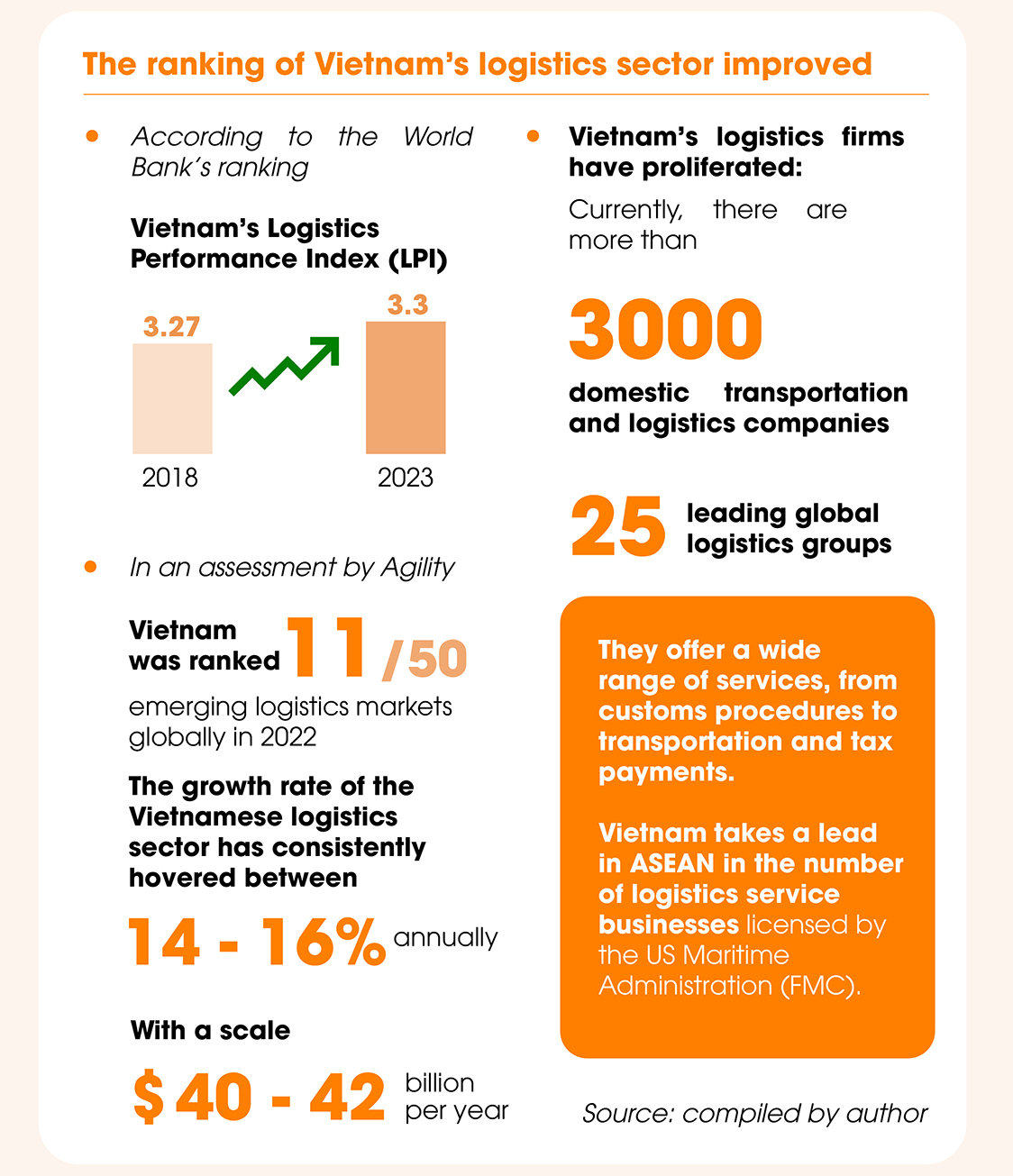

Vietnam climbs one place in the Emerging Markets Logistics Index, according to a report by Agility, a global transportation and logistics service provider, announced in May 2023. The report also points out that being in the top 10 is a testament to Vietnam’s success in developing the logistics industry, as well as showing that Vietnam has benefited from the trend of supply chain diversification among multinational corporations.

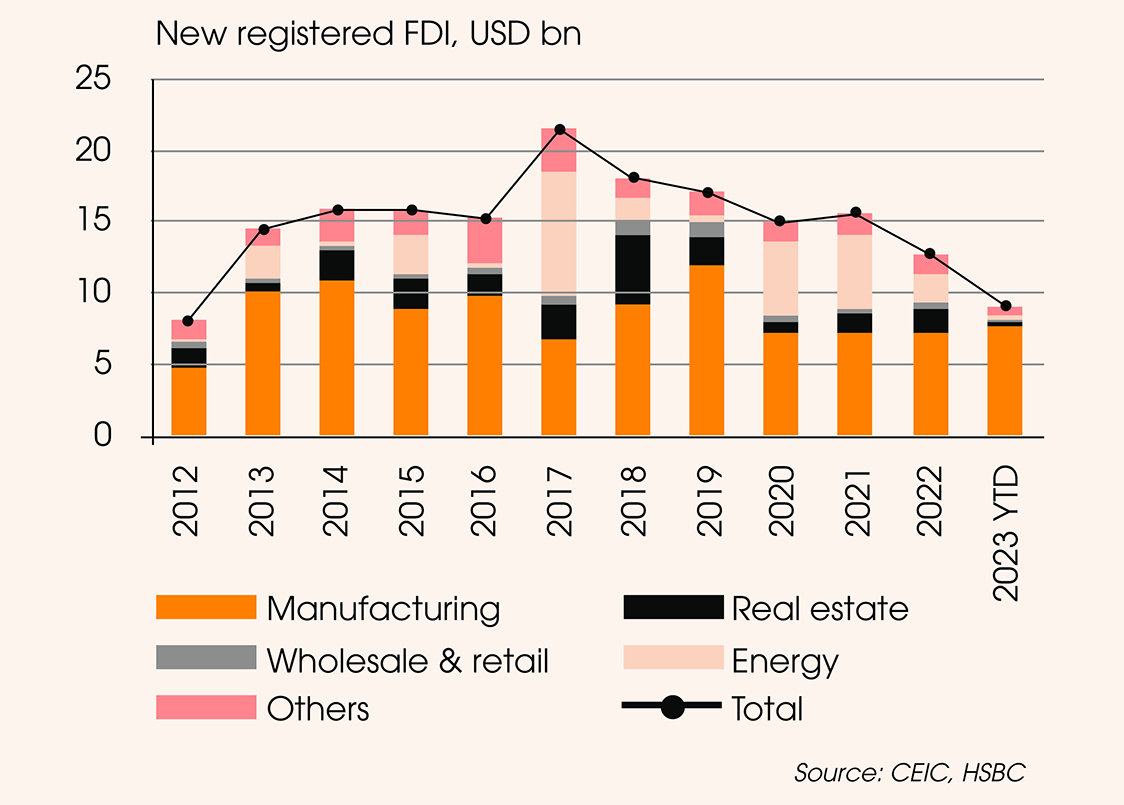

An HSBC report released in mid-September shows that new FDI into Vietnam’s manufacturing sector so far this year is already more than in each of the past three years. “While much of the investment initially entered the lower value-add textile and footwear space, Vietnam has quickly climbed up the value chain, growing into a key hub for electronics assembly,” says the HSBC report.

As a result, tech giants such as Samsung, LG, and Apple have flocked to Vietnam, which has led to the arrival of their suppliers.

● According to data by Mordor Intelligence

Vietnam’s logistics market size is estimated at $45.19 billion in 2023

$45,19

billion

in 2023

And is expected to reach $65.34 billion by 2029

$65,34

billion

by 2029

Growing at a CAGR of 6.34% during the forecast period.

6,34%

According to a report about logistics published by VinaCapital in mid-2023, Vietnam has one of the fastest-growing logistics sectors in the world (with an annual growth rate of 14 – 16% in recent years).

In particular, the sector is expected to continue to grow for years to come, driven by the continued growth of the manufacturing sector, middle-class consumers, e-commerce, as well as demand for perishable food and other products.

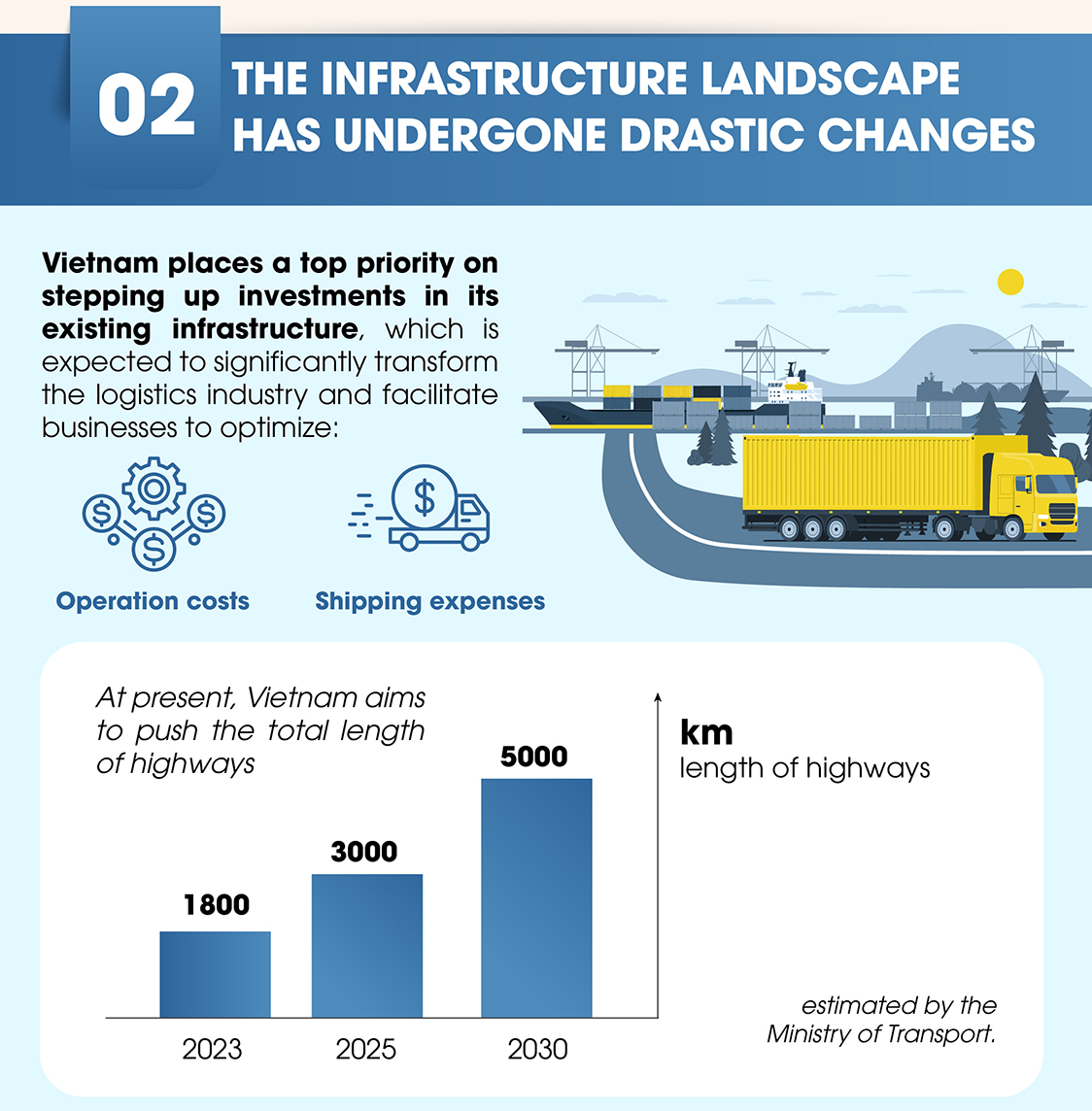

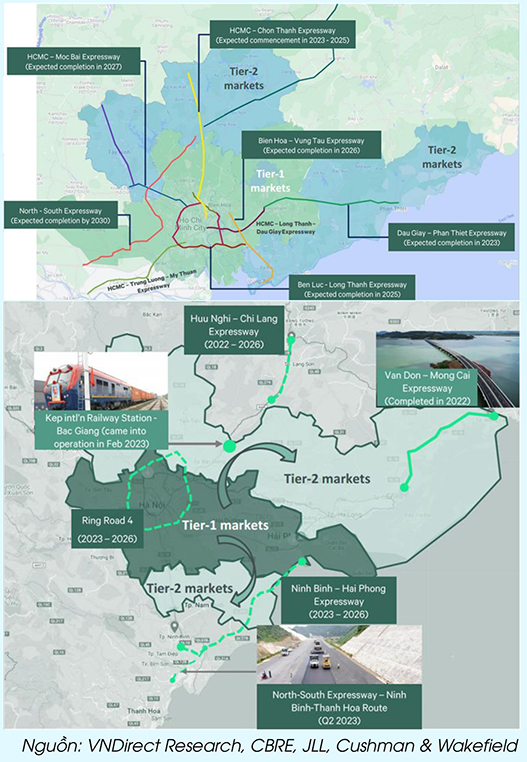

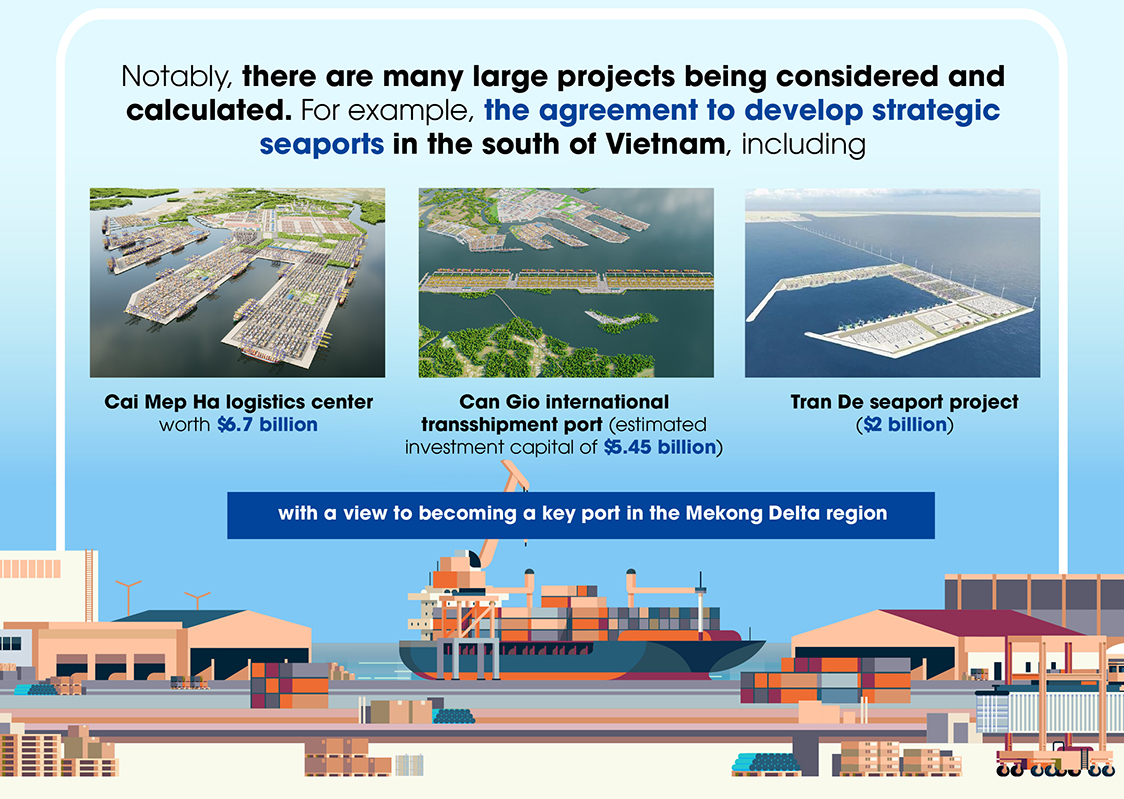

There are many highways, connecting roads, airports, and seaport infrastructure projects being planned or under construction across the country.

Particularly in the southern region, many infrastructure and road projects have been approved and begun to be implemented, such as Long Thanh international airport, Ho Chi Minh City ring road, and highways in the Western region, which are expected to significantly change the face of infrastructure in the near future.

As the connecting transport network is improved, the tier-2 market welcomes an investment capital inflow

During this term, the National Assembly has decided to spend VND 2.87 quadrillion on the medium-term public investment plan while investing an additional VND143 trillion of the Socio-Economic Recovery and Development Programme in important works and projects in the 2022-2023 period.

A significant share of this resource is allocated to transportation infrastructure, the lifeblood of the economy, and the logistics industry.

Given the ongoing manufacturing relocation trend, there is an increasing demand for logistics services and infrastructure in Vietnam. However, the market witnesses a scarcity of new supply and land banks. In the Southern market, limited new supplies will be put into operation in the 2024 – 2027 period, mainly from big industrial park developers, according to a report on the industrial property market by VNDIRECT Securities Corporation.

However, many logistics infrastructure and real estate projects have sprung up across the localities nationwide (warehouses, yards, multi-purpose warehouses, logistics centers, etc.). Besides projects in operation, many other construction plans are in discussion.

Another noticeable change is the investment trend in industrial property products:

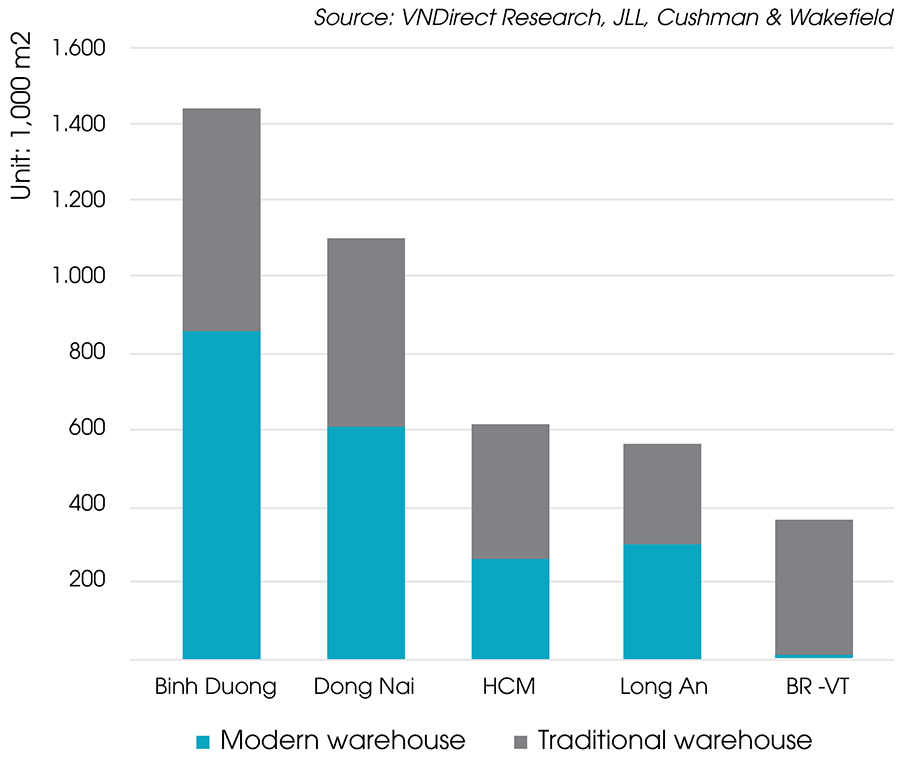

● First, manufacturers and investors are gradually targeting the tier-2 markets, which are supposed to have more competitive costs. For instance, more projects are being developed in Ba Ria – Vung Tau than in the traditional markets of Dong Nai, Ho Chi Minh City, and Binh Duong. The trend is fuelled by infrastructure improvement, facilitating easy connectivity between two markets.

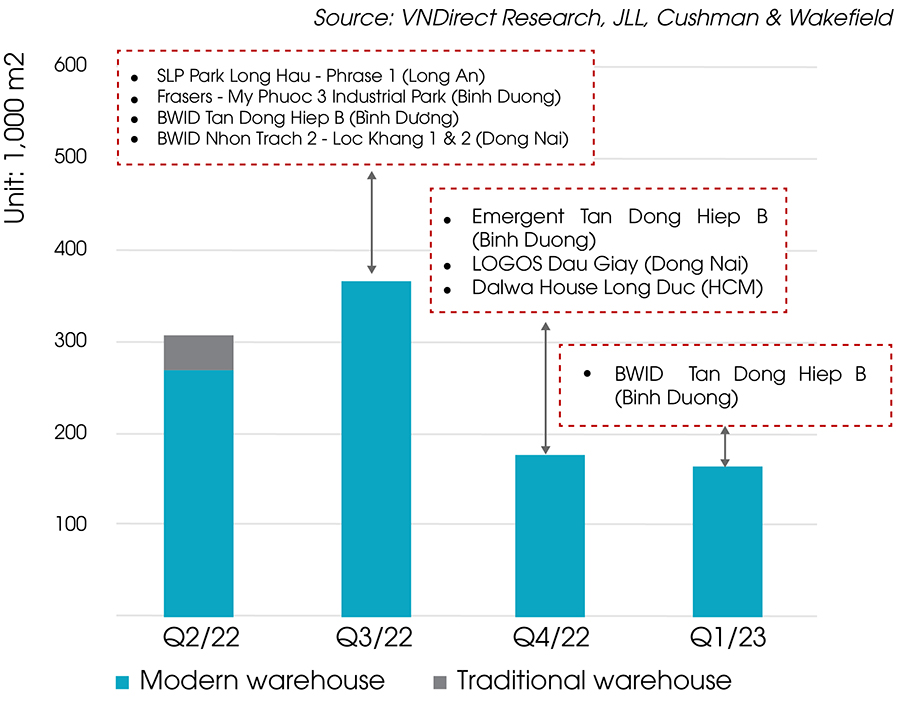

● The second trend is the rise of modern, multi-purpose warehouses replacing traditional warehouses, thanks to increased demand for e-commerce sales. VNDirect’s analysts cite research showing that for $1 billion of additional e-commerce sales, it would require an additional 92,903 sq.m of logistic space. Following that, more than 2.2 million sq.m of additional e-commerce-dedicated logistic space is estimated to be required by 2026.

It is also noticeable that the trend of leasing activities for ready-built factories and warehouses continues to gain traction in both the Northern and Southern regions in the first half of this year.

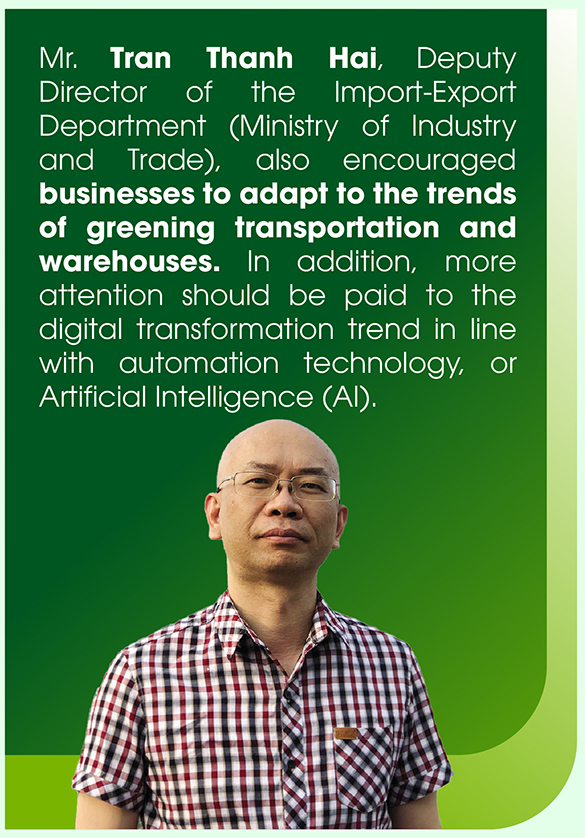

Logistics investment and production activities are under pressure from the sustainable development trend, the green economy, and the utilization of eco-friendly materials to mitigate the impact of climate change.

Logistics firms must embrace change to increase competitiveness, given that the “greening” supply chain has become a hot topic. Unless Vietnamese businesses meet the requirements, they will be out of the global game.

In the renewable energy field, the national Power Development Plan VIII has been approved, which promises to remove energy bottlenecks for production.

On the other hand, factories are facing legal issues related to renewable energy usage in industrial zones. However, if this issue is resolved, the green production trend will be further promoted.

In reality, despite many challenges with technology, it can be seen that logistics operators have started to use electric vehicles for delivery or install solar power panels on the trucks.

The second key trend is the orientation toward developing a market for the purchase and sale of carbon credits and greenhouse gas emission quotas. The roadmap for this project outlines the commencement of piloting by 2025, with official operation by 2028. At present, many warehouses have stepped up the use of green materials and improved environmentally friendly production processes to reduce greenhouse gas emissions.

Comment