Forecast to hit up to US$ 1.8 billion in this year, cold chain supply market is considered to be “gold mine”, attracting the great investment and exploitation sources from players.

Cold supply chain was not known as a popular concept in Vietnam market in 2019 and previous years when it was only served for fisheries sector. However, the state of affairs was completely reversed by Covid-19. Accordingly, the online shopping trend was quickly and sharply promoted by the epidemics in order to avoid exposure. Furthermore, a myriad of vaccine importers were approved by the Government to speed up the public vaccination as soon as possible, resulting in suddenly high cold warehouse demand.

A recent statistics released by the competent authorities released that only 48 cold warehouses with capacity of 700,000 pallets are available for agricultural and fisheries product storage service while thousands of cold warehouses with total capacity of 2 million tons of products for certain markets are served for certain markets (mainly for export). The demand on food, agricultural and fisheries goods storage was not satisfied by the available cold warehouses.

If the goods were supplied as usual, the enterprises’ built-in cold chain systems would be qualified as what acknowledged by Mr. Nguyen Dinh Tung, Chairman of Board of Directors of Vina T&T. However, in the current pandemic context, the supply chain may be broken at any time. Hence, the enterprises having insufficient cold warehouse facilities would struggle with goods jam, outsourcing would be forcedly applied.

Ms. Trang Bui – Senior Director of JLL’s Vietnam Market provided fisheries export field as a typical example which was characterized by the sector with the highest demand on cold chain supply in the pandemic peak period. Up to 30%-50% of fisheries export POs were canceled, resulting in escalating inventories. The cold chains were required to absolutely maximize its capacity.

The experts revealed that restricted supply is partially caused by more time consuming for cold chain facility construction than other logistics properties. Construction of cold chain facilities was much more complicated and expensive than the standard ones.

This is relatively understandable when most of industries are nearly frozen in the pandemics. Then, cash flows are bravely injected into development and upgrade of cold chain supply services by the investors.

Particularly in September 2020, 5 smart cold chain supplies were inaugurated to construct in Mekong River Delta by the Vietnam Green Startup Foundation (VGSF), upon receipt of sponsor funds from FinExpro Committee (Kingdom of Belgium), to launch the project on connecting start-up farmer supporting resources. The first cold chain facility of this project was invested with total capital of nearly VND 24.5 billion, covering area of 10,000 m2 (Cang Long District, Tra Vinh Province). Upon completion, the cold chain facility was operated as a cold agricultural product storage and preservation center to serve for SMEs and agricultural cooperatives before the exporters were connected to export to EU and Middle East markets.

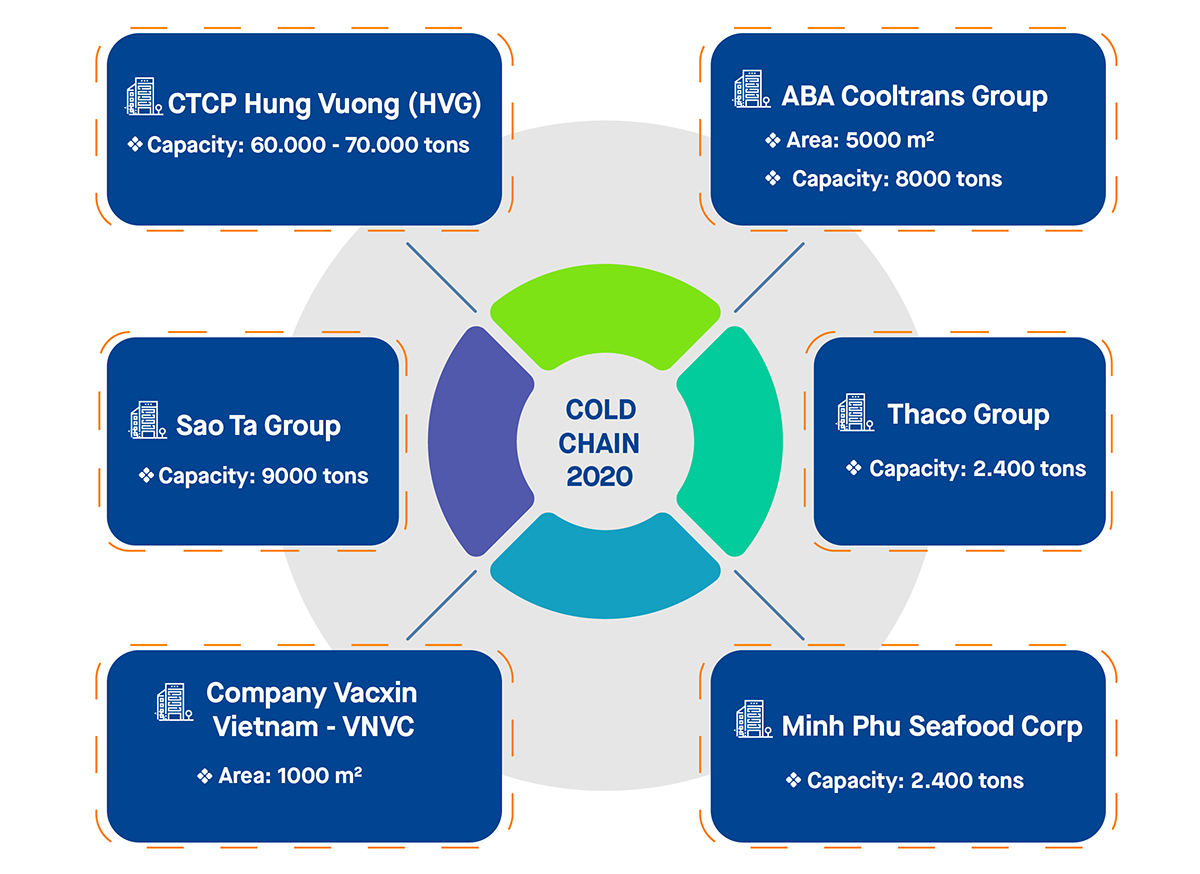

Also in 2020, Mien Dong 1 Cold Distribution Center (DC) was also put into operation by ABA Cooltrans Group. Located at Linh Trung II Processing Zone, Binh Chieu, Thu Duc, Ho Chi Minh city, the DC was characterized by investment value of VND 250 billion. This was ABA’s third cold DC behind 2 DCs in Ho Chi Minh City and Hanoi, increasing total area of available cold DCs up to 5,000 m2, fulfilling the estimated capacity of 8,000 tons. Mr. Luong Quang Thi – Chief Executive Officer of ABA unveiled that with Mien Dong 1 DC, ABA may actively prevent its customer’s Business Continuity Planning (BCP) from interruption during pandemic difficulties.

In addition to such players, Thaco Group’s big cold chain system with capacity of 2,400 tons is recently invested in Chu Lai Economic Zone to store and preserve the export fruits. In 2021, cold chain systems and delivery-transportation centers are continued to expand and complete by this player to increase the export fruit output to 120,000 tons/year through Chu Lai Port.

With cold chain supply system to serve for vaccine storage demand, right at the mid of 2020 when the difficulties on Covid-19 vaccine transportation, storage and maintenance were anticipated, VNVC imported a large number of equipment and constructed deep-negative cold chain supply system as disclosed by Ms. Tran Thi Trung Trinh, Quality Control Director of VNVC.

Currently, VNVC owns 49 separate vaccine warehouses and 2 master special vaccine warehouses at 20C-80C, pre-cold chain facilities and 3 deep-negative cold chain facilities with total area of over 1,000 m2, capacity of over 4,000 m3, seat capacity up to 170 million vaccine doses at a time.

All VNVC cold chain supply systems are equipped with onsite and online temperature monitoring system, remote controller and GSM-based alarming. Moreover, VNVC’s vaccine storage and transportation procedure is complied with Good Storage Practice (GSP) and Good Distribution Practice (GDP) as prescribed by the Ministry of Health.

With current impetus, Ken Research (USA) forecast that Vietnam cold chain supply market scale is estimated to hit US$ 1.8 billion in 2021. Especially, the market potential could be even larger, as cold chain growth is often followed by growth of retail, food and beverage production chains. The next 5-year forecast released by McKinsey unveiled that when retail market is continued gain with average growth rate of 7.3%/year, cold warehouse and transportation services are all required by players to keep the foods in fresh and premium conditions.

Another noteworthy point is that the invested cold chain supply systems are complied with the international safety standards. Mr. Nguyen Dinh Tung shared that each plant of Vina T&T is provided with a separate cold chain warehouse system with fund up to tens of VND billion and all construction materials are selected in accordance with the world’s safety criteria.

Meanwhile, ABA Cooltrans also confirmed the construction materials of cold chain facilities are selected by light-weight and environmental friendly criteria and the monthly EIA report is submitted by each cold DC.

Comment