Vietnam continues to record a positive GDP growth in 2Q21: Vietnam’s GDP expanded 6.61% y-o-y in 2021, and this presented the 1H21 GDP’s growth rate at 5.64% y-o-y, higher than last year growth rate of 1.82%, yet lower than the rate of pre-Covid-19 years.

The country is facing many challenges and posed several restrictions to pursue the dual goal: “disease prevention and economic development” owing to Covid-19

outbreak in some localities, including some highlights such as:

Newly registered enterprises in 1H21 increased in both quantity and registered capital. However, the number of enterprises suspending operations also increased by 24.9% y-o-y.

The property market in 2Q21 as unveiled by Overview Study on Vietnam property market in 2Q21 launched by JLL Vietnam was found that the property market is “brighter” than the concern except for the retail property market. A series of positive indicators in the last 6 months were released by the report.

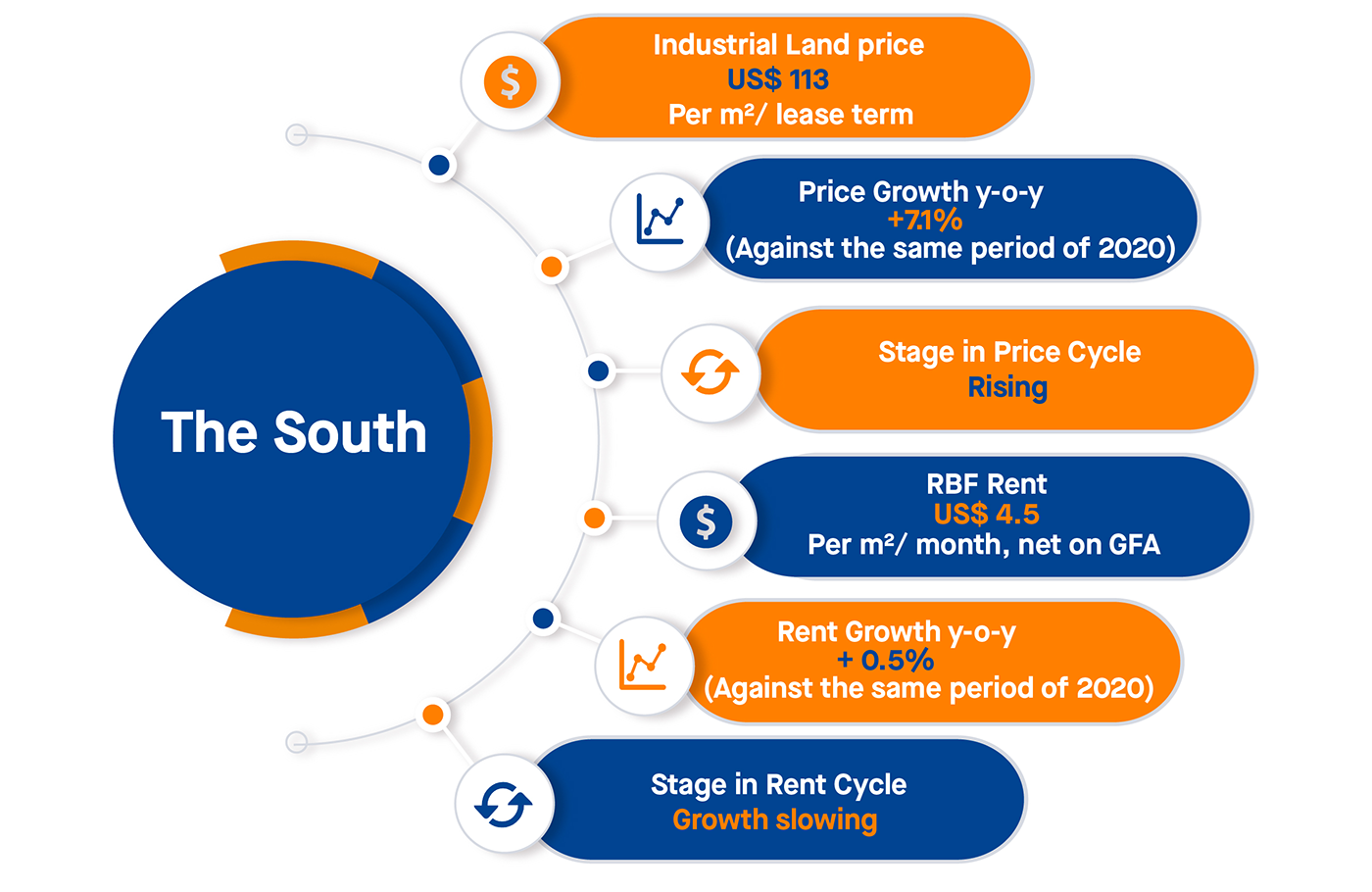

The report released by JLL Vietnam unveiled that in the South of Vietnam the

Occupancy Rate of IL and RBF is 85% and 86%, respectively; it was still stable with a series of deals to be fulfilled in Ba Ria – Vung Tau regardless of the 4th Covid-19 wave headwind, mainly initiated by the heavy-duty manufacturers who required a large land resource. It is possible to see that feasible solutions have been successfully found by both investors and tenants to continue to thrive in the pandemic context. Vice versa, RBF was recorded with the bigger business expansion of the available players than the new ones. With the above disclosures, IL was recognized as a long-term investment form for production with powerful growth momentum by years, while RBF rental was stagnant, adversely affecting this built property form.

With promising signs from Vietnam manufacturing and epidemic control, IL was forecast to continue obtaining sharp growth; RBF would be busy again with approximately 940,000 m2 to be marketed at the end of 2021. With the optimistic prospects for Vietnam’s future manufacturing, the infrastructure system was ceaselessly improved and reconstructed by the local authorities, typically Phan Thiet- Dau Giay Expressway, Bien Hoa – Vung Tau Expressway, Ben Luc – Long Thanh Expressway Projects located in the key industrial markets surrounding HCMC.

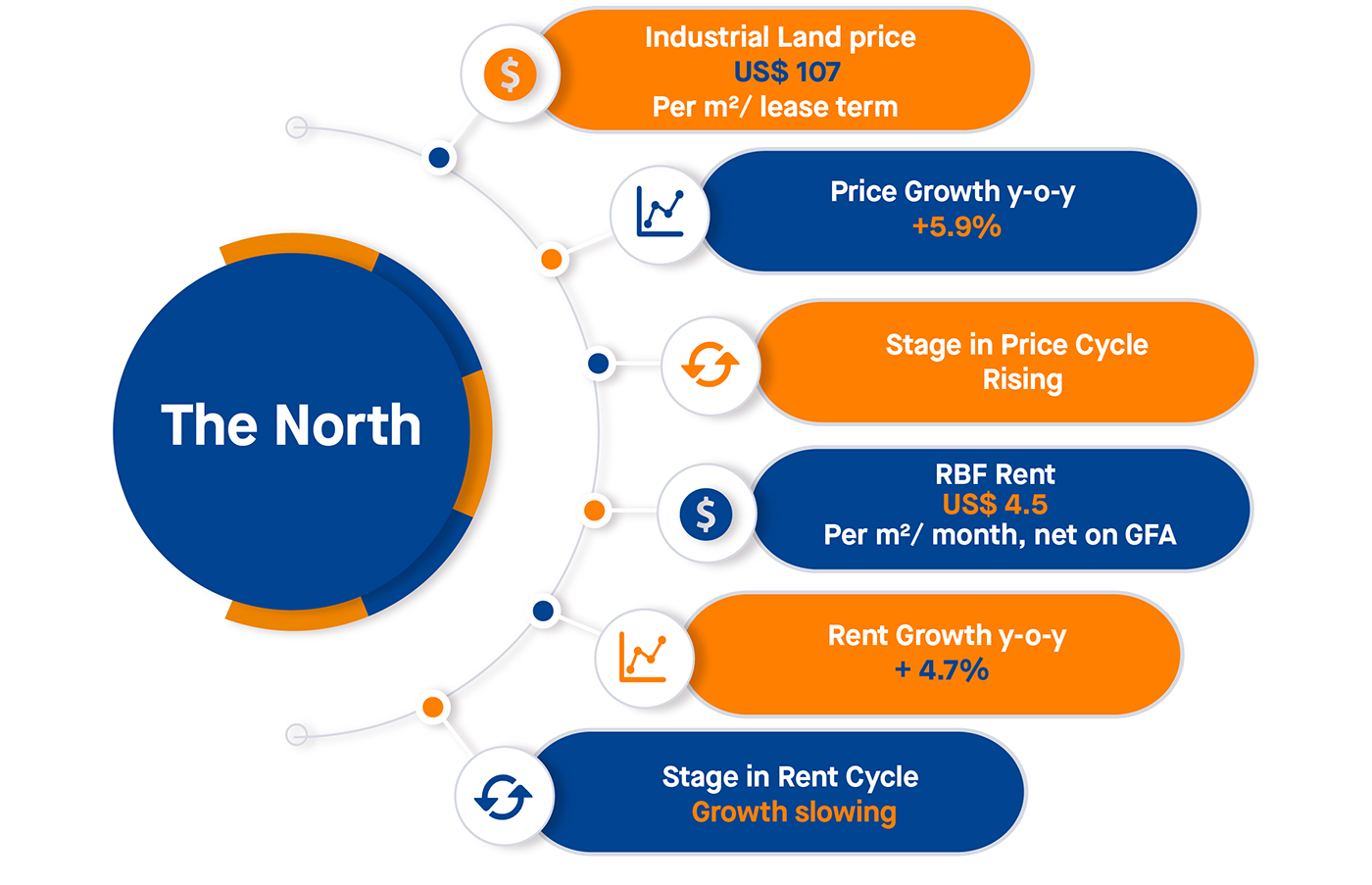

In the North, JLL Vietnam unveiled that due to Covid-19 outbreaks, the industrial

property market becomes quiet in 2Q21 when no outstanding FDI projects are received, mainly small-scale projects. That is why the occupancy rate of the Northern IL is maintained at 75%; RBF was recorded with a decrease against Q1/2021 as the total number of enterprises to be suspended climbed by 22% against the same period of last year.

Until the end of 2021, Pegatron will increase investment capital into Vietnam following Hai Phong – Domiciled project is regarded as an optimistic sign for future industrial property demand. The industrial property market in the Northeast is recognized with a great prospect in attracting investors thanks to advantages in terms of rent and

increasingly improved infrastructure. Therefore, the land price in such areas is

expected to climb up by 8-10% against the same period of the last year; the RBF market is also busy with a myriad of new investors penetrating the market such as GNP Industrial or Viet Nam Industrial Joint Stock Company.

Comment