If the global minimum tax issue is not addressed soon, Vietnam may “lose steam” in the race to attract FDI. This can happen when international investors choose other countries with lower minimum taxes to invest in. If Vietnam continues to maintain its current tax rate without introducing adaptive measures, it may no longer be attractive to international investors and lose opportunities to attract FDI.

An important note was just announced by Minister of Planning and Investment Nguyen Chi Dung at the Government’s Online Conference with localities held in early April 2023. It said that FDI registered in Vietnam in the first quarter decreased by 19.3% year on year.

In fact, this was mentioned by the Foreign Investment Agency in the report on FDI attraction in the first quarter of the year. Accordingly, the amount of the period was nearly 5.45 billion USD, down 38.8% year over year. The difference in statistics is attributed to the fact that just a few days after the Foreign Investment Agency published data on FDI attraction in Q1 2023, Sumitomo Mitsui Banking Corporation (Japan) spent $1.5 billion on buying VPBank stocks. With this additional investment, FDI registered in Vietnam increased significantly, narrowing the decrease to only 19.3%.

The lack of large-scale projects is the most fundamental reason the Foreign Investment Agency pointed out, causing a decline in FDI registered in Vietnam. In contrast, projects with an investment scale of less than 1 million USD account for nearly 70% of new projects.

“Urgent”, “pressing”, etc., are what experts and businesses often describe in discussing the global minimum tax issue. Not only will Vietnam “lose steam” in the race to attract big investors, but it will also lose the right to impose additional taxes. This is because if the country does not have a timely countermeasure, starting from 2024, foreign investors in Vietnam will have to pay the difference in taxes to the country of origin of investment.

According to a review of the General Department of Taxation, about 1,000 foreign enterprises in Vietnam, depending on the level of incentives enjoyed and the remaining preferential time, are subject to the minimum global tax payment. Last August, the government set up a working group to tackle the global minimum tax issue. Both the Ministry of Finance and the Ministry of Planning and Investment were assigned research tasks by the Prime Minister to come up with appropriate countermeasures. Prime Minister Pham Minh Chinh once again emphasized this at the recent Government Conference with localities.

Because this kind of support is provided through the registration and payment procedures after enterprises have fulfilled their tax obligations, the Government of Vietnam will be able to mobilize financial resources and payment easily.

This is also something frequently mentioned by many experts and tax advisors. According to Mr. Thomas McClelland, Deputy Director-General in charge of Tax Advisory Services at Deloitte Vietnam, in the immediate future, Vietnam may consider the solution of applying a QDMTT to gain the right to collect additional taxes before other countries. This is a measure that some countries have announced their intentions to adopt, such as Hong Kong, Singapore, and Malaysia.

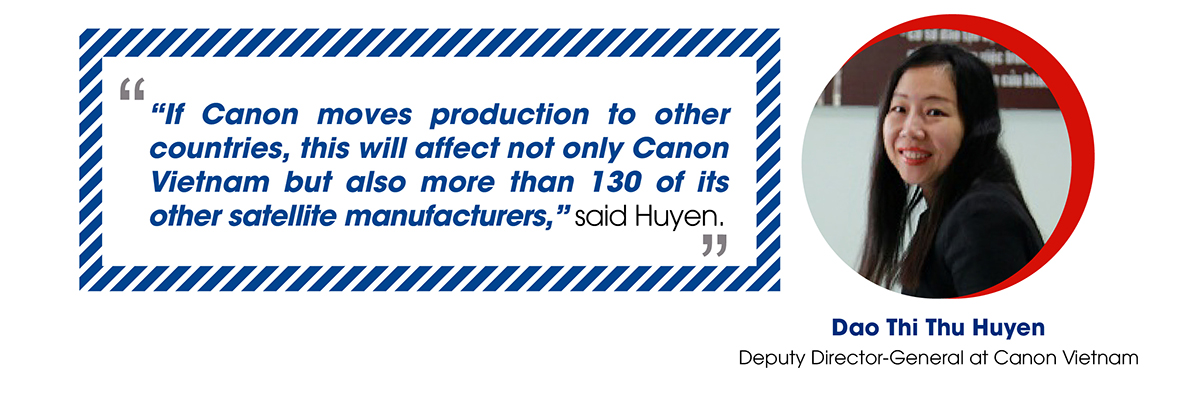

Regarding this, Ms. Dao Thi Thu Huyen, Deputy Director-General at Canon Vietnam, thought Thailand would implement electricity bill support for investors if the global minimum tax were imposed. According to her, Canon Vietnam currently supplies more than 50% of the Group’s output, and one of the reasons why Canon invests in large-scale production in Vietnam is to enjoy tax incentives. But if Vietnam does not have a timely response to the imposition of the global minimum tax, the Group will likely consider allocating production to other sites with other competitive advantages.

The time for applying the Global Minimum Tax Rule is approaching, requiring Vietnam to accelerate the process of researching policies and solutions when it is widely implemented.

The deputy minister said that Vietnam had made necessary administrative reforms to minimize business costs. In particular, the Government issued Resolution No. 31/2023 at the regular Government meeting in February 2023. Accordingly, the Ministry of Finance was requested to assume the prime responsibility and coordinate with the Ministry of Planning and Investment and relevant agencies to urgently complete the study, finalize the comprehensive report on the global minimum tax mechanism, and then report to the Prime Minister in March 2023. Previously, on August 4, 2022, the Prime Minister established a Special Working Group to study and propose related solutions.

➨ The clock is ticking. Therefore, it is time that Vietnam sped up to cope with the global minimum tax issue.

Comment